Source: Devonyu / Getty Images

In this edition: 💰 Finance Morgan Stanley finds adaptation now ranks as the third-highest global sustainability investment focus, Al Gore’s natural capital-focused fund raises US$375mn & more. 🏛️ Policy EU-wide climate resilience and risk management initiative opens for public consultation, Washington state homeowners sue over climate-induced insurance premium rises & more. 🤖 Tech Real estate listings platform removes First Street-powered risk ratings, wetland-regenerating biomaterials start-up closes seed round & more. 📝 Research Another round-up of papers and journal articles on all things climate adaptation.

Global Investors Prioritizing Resilience, Increasing Adaptation Focus

Over one-half of institutional investors say climate resilience is a “core part” of their risk-return analyses of potential investments in infrastructure and real estate, a survey of over 900 firms by Morgan Stanley shows.

The poll, included in the bank’s most recent ‘Sustainable Signals’ report, also shows around 75% expect extreme weather shocks and climatic shifts to shake up asset prices over the next five years, with more than one-third saying major, market-wide pricing impacts are likely.

North American investors are more likely than those in other parts of the world to claim climate resilience is an important investment consideration, with 65% saying this is a core concern. For Europe and Asia-Pacific, the shares are 44% and 50%, respectively.

Adaptation now ranks as the third-highest global sustainability investment focus — up from sixth last year — trailing only renewable energy and energy efficiency. Twenty percent of respondents ranked clean water and sanitation solutions, a theme linked to adaptation, in their top five priorities, while 14% did the same for nature-based solutions.

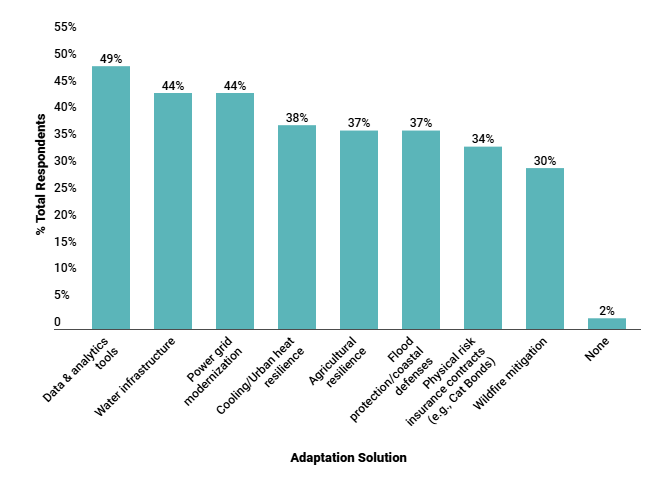

As for the top adaptation solutions investors say they are prioritizing over the next 1-3 years, almost half (49%) say data and analytics tools, 44% water infrastructure, 44% grid modernization, and 38% cooling and urban heat resilience.

What Solutions Are You Prioritizing For Climate Adaptation Investments Over The Next 1-3 Years?

The global results mask some important regional differences. Only 18% of North American respondents include climate adaptation in their top five sustainable investment priorities, compared to 24% in Europe and 26% in Asia-Pacific. When asked what barriers stand in the way of greater investment in adaptation and resilience, North American investors are more likely to cite regulatory or policy uncertainty than their peers. Proportionally more European and Asia-Pacific investors say the lack of common market language, standard definitions, or classification frameworks is an obstacle.

In Brief

Severe thunderstorms in the US caused US$42bn in insured losses over the first nine months of 2025, according to Moody’s. Per-event costs ran 31% above the prior decade’s average, signaling what the company calls a new “normal” for extreme weather. Severe convective storm (SCS) losses have now outpaced those inflicted by hurricanes since 2020, forcing the insurance industry to seek out new ways to understand, quantify, and manage this escalating risk, says Moody’s. (Artemis)

A new climate impact bond aims to raise US$200mn by 2026 to finance weather and climate observation tech in poor, climate-vulnerable countries. The UN-backed Systematic Observations Financing Facility (SOFF) opened the contribution window for the instrument on November 14. If fully capitalized, the bond would help 30 Least Developed Countries and Small Island Developing States meet international Global Basic Observing Network standards, augmenting their access to internationally shared weather data and reducing forecast errors. The World Bank estimates that closing the basic weather data gap could generate US$5bn in direct annual benefits and engender US$160bn in wider economic gains across agriculture, energy, water and transport. (Systemic Observations Financing Facility)

Just Climate, the natural capital-focused arm of Al Gore’s Generation Investment Management, has raised US$375mn for innovative solutions for land degradation and climate-resilient agriculture. Investors include Achmea Investment Management, the Environment Agency Pension Fund, and Royal Bank of Canada. Just Climate also confirmed a new investment in Indian agritech platform AgroStar, which serves more than 10 million smallholder farmers with climate-resilient practices and products. (Just Climate)

Investment manager Deetken Impact and the Government of Canada have pledged CAD$106mn (US$76mn) to a new Inclusive Climate Action Fund (ICAF) targeting climate-resilient agriculture, agroforestry, and other adaptation and mitigation projects in Latin America and the Caribbean. The blended finance vehicle plans to raise US$300mn to unlock more than US$1.2bn in private capital and expand access to climate solutions to more than one million people. (Deetken Impact)

The United Nations Environment Programme Finance Initiative has backed a new white paper laying out “Key Principles and Methodological Approaches for the development of the mitigation co-benefit and Adaptation for Resilience” (mARs) under the ASEAN Sustainable Finance Taxonomy. The authors argue that uncertainty over the bankability of adaptation projects is a major obstacle to private investment, and claim that reforming the region’s taxonomy could help remove this blocker. (UNEP FI)

✂️ Tired Of Cyber Monday Sales?

Me too. Which is why I’m not running one this year. Could I get more free readers to upgrade to paying members if I did? Sure. But here’s the thing — Climate Proof isn’t exactly rolling in dough. We need more members paying full freight to keep us going through 2026. And as things stand, for a niche, highly technical, highly regarded B2B publication, Climate Proof is already very competitively priced.

So if you were hoping for a deal, I’m sorry to disappoint. But you can’t build a credible media company on the cheap.

If you value what we’re producing at Climate Proof and want to support the best adaptation finance, tech, and policy insights around, then please consider upgrading to a paid membership below.

With thanks,

Louie Woodall

Editor

EU Opens Public Consultation on Climate Resilience Law

The European Commission opened its proposed EU-wide climate resilience and risk management initiative for public consultation, with the aim of creating an “integrated framework” that hardens member states against worsening floods, fires, and other climate hazards.

Running from December 1 through February 23, 2026, the consultation is meant to shape a legislative package — slated for late 2026 — that would embed climate risk and resilience across public policy and promote investment in climate-proofing priorities.

Feedback from an earlier call for evidence shows strong support for tougher, more coordinated resilience policy. Individuals, research institutions, businesses, and non-profits called for mandatory “resilience-by-design” in public spending and procurement, harmonized climate risk assessment standards, and more stable long-term funding for adaptation, among other things.

European Commission. Source: stevenallan / Getty Images Signature

The current consultation is looking for more targeted input on governance, finance, regulatory standards, cross-border coordination, and innovation. It also provides clues on the Commission’s likely approach to drafting legislation. For example, the online questionnaire says the Commission “intends to ensure that the future climatic conditions are duly integrated into all relevant EU policies and frameworks governing sectors and stakeholders vulnerable to climate change.”

Elsewhere, it lays out certain “aspects and requirements” that it considers “essential to better prepare our economies and societies for climate change.” These include a definition of climate resilience and adaptation targets and the development of climate risk assessments for the most affected policy sectors.

In Brief

A White House–appointed panel weighing reforms to the Federal Emergency Management Agency (FEMA) will present its final recommendations at a public meeting on December 11. Led by Homeland Security Secretary Kristi Noem and Defense Secretary Pete Hegseth, the 13-member FEMA Review Council will unveil its proposal and vote on a draft final report after months of field hearings and public testimony. President Trump has repeatedly criticized FEMA as slow, politically biased, and inefficient and long voiced support for its downsizing. (E&E News)

Two homeowners in Washington state filed a proposed federal class action against oil majors including ExxonMobil, Shell, Chevron, BP, and ConocoPhillips. They allege the companies led a decades-long campaign to mislead the public about the risks of climate change — actions the plaintiffs say have contributed to rising property insurance premiums in their area and across the country. The lawsuit alleges the companies suppressed internal research dating back to the 1960s showing “catastrophic” climate impacts from fossil fuel use, and continued to produce and sell planet-warming products that are the source of worsening extreme weather events. The petitioners say their premiums more than doubled after 2017, mirroring a 51% statewide increase cited in the complaint. (My Northwest)

Los Angeles County officials moved to shore up long-term wildfire recovery financing by approving a new tax-increment district for the Santa Monica Mountains. This allows future property tax growth in the area to be reinvested locally in fire-prevention and protection measures without raising rates. The funding will target infrastructure rebuilding, road and water system repairs, fire safety upgrades and broader climate resilience projects. (Santa Monica Daily Press)

Canada’s government is retooling its nationwide severe weather alert system. The new color-coded approach ranks hazards from yellow to red. Yellow alerts are the most common, and are issued when extreme weather events may cause damage, disruption, or health impacts. Orange alerts are less common, triggered when severe weather is likely to cause significant damage, disruption, or health impacts. Red alerts are the rarest and most serious. They are issued when very dangerous and possibly life-threatening weather will cause extreme damage and disruption. The update aligns Canada’s system with global best practices promoted by the World Meteorological Organization. (Government of Canada)

Swiss voters overwhelmingly rejected a proposed inheritance tax on the ultra-rich intended to raise finance for climate mitigation and adaptation. The initiative, which was backed by the youth wing of the Social Democratic Party, would have levied a 50% tax on inheritances and gifts over 50 million francs (US$62mn). It was defeated by 78% of the vote, after campaigning by the business lobby Economiesuisse and others warning the tax would lead to the forced sale of companies and an exodus of the super-rich. (CNBC)

Spain’s economic growth could be undermined by worsening climate extremes without adaptation, the Organisation for Economic Co-operation and Development (OECD) warns. In a new report, the group calls on policymakers to undertake targeted adaptation investments and prioritize strengthening existing, climate-vulnerable infrastructure. It also cautioned against new development in high-risk flood zones and argued for “expanding flood protection infrastructure” to “significantly mitigate economic and human impacts.” The warning follows deadly floods in October 2024 that killed more than 200 people in Valencia, one of the country’s key industrial and agricultural regions. (OECD)

Cities are struggling to implement nature-based solutions (NbS) for climate resilience because of a range of technical, social, and governance barriers, according to a new international study led by the University of Surrey's Global Center for Clean Air Research (GCARE). The analysis, based on more than 500 scientific studies, identifies a total of 21 often-overlooked obstacles that cause green and blue infrastructure — including parks, wetlands, rivers, and green roofs — to underperform. These range from clashes between NbS concepts and governments’ net-zero targets, to safety and security fears. The study outlines 12 recommendations to untangle NbS solutions from these obstacles, including the adoption of “participatory approaches” that give communities a say in their implementation. (Phys.org)

Zillow Drops Climate Risk Scores Amidst Industry Pushback

Zillow, the largest US online real estate platform, has quietly removed climate risk ratings from property listings after pressure from real estate agents and a major California data provider, the New York Times reports.

The ratings, launched last year and powered by climate intelligence company First Street, rated individual properties for flood, wildfire, wind, heat and air quality risk. However, the Times says that the California Regional Multiple Listing Service (CRMLS), one of the nation’s largest listing databases, complained to Zillow about the accuracy of the flood ratings. Art Carter, CEO of CRMLS, said that the flood data can have a "significant impact” on a property’s desirability — suggesting it made it harder for flood-prone homes to find buyers.

Evidence suggests climate risk forecasts do influence those shopping for homes. A large experiment on Redfin, analyzed in a working paper from the National Bureau of Economic Research, found that when flood risk data was shown to home shoppers, they shifted searches toward lower-risk properties.

RoschetzkyIstockPhoto / Getty Images

Zillow now links to First Street’s data rather than embedding risk scores directly on listings, and argues it still supports informed consumer decisions. First Street has maintained that its climate risk models are peer-reviewed, publicly documented and validated by banks, federal agencies, and insurers.

On LinkedIn, Madison Condon — Associate Professor at Boston University School of Law — said that while First Street’s models may provide good insights on certain risks and hazards at a portfolio level, property-specific data “needs to be taken with a substantial grain of salt.”

“Ultimately, I hope we get to a place where the burden is not solely on an individual consumer to try to investigate their climate risk exposure. There needs to be a broader institutional solution to this problem, including getting banks and regulators to do a better job of risk assessment on their end,” she added.

In Brief

Wildfire intelligence start-up Overstory raised US$43mn in a Series B round led by Blume Equity and Energy Impact Partners. The funding will accelerate development of Overstory’s satellite-based vegetation risk models and support a global expansion as extreme weather, rising labor costs, and escalating vegetation risks force power companies to overhaul their operational risk management approaches. Overstory has also unveiled a new Fuel Detection Model that identifies the most ignition-prone vegetation across utility networks, helping companies prioritize adaptation efforts and pre-position resources in advance of sudden blazes. (Overstory)

Ponda, a UK biomaterials start-up, has raised $2.4mn to scale its plant-based insulation made from Typha, a wetland crop. The funding will support expanded European wetland farming and peatland restoration, which could enhance the flood mitigation benefits of these natural ecosystems. Ponda’s BioPuff material has applications for fashion and outdoor clothing brands looking for alternatives to carbon-intensive synthetics and animal down. (Ponda)

Scientists and technologists are racing to adapt one of the world’s most prized — and most climate-sensitive — cash crops: cardamom. At the Indian Cardamom Research Institute and Kerala Agricultural University, experts are developing drought-tolerant, pest-resistant varieties of the popular spice using genetic markers. Infrastructure is also adapting. Cardamon pods have to be dried once harvested to retain their quality. Social enterprise Graamya has rolled out low-cost heat-pump dryers to replace the traditional wood-fired systems used for this task, providing a cheaper and more efficient drying solution. (BBC)

RESEARCH

Scaling up actionable climate knowledge (PNAS)

Inclusion of wellbeing impacts of climate change: A review of literature and integrated environment-society-economy models (The Lancet Planetary Health)

Property insurance and disaster risk: New evidence from mortgage escrow data (National Bureau of Economic Research)

Climate resilient urban development: An agenda for Small Island Developing States (npj Urban Sustainability)

Extreme precipitation and flooding in Berlin under climate change and effects of selected grey and blue-green measures (European Geosciences Union)

Spatially explicit climate adaptation pathways for coastal archetypes: A quantitative narrative approach (Ocean & Coastal Management)

Sea level rise and flooding of hazardous sites in marginalized communities across the United States (Nature Communications)

Drought and extreme heat reduce wheat and maize production in the United States by lowering both crop yields and harvestable fraction (Earth’s Future)

Managing rising risks: Climate-resilient shorelines for Canada (University of Waterloo)

Observed shifts in regional climate linked to Amazon deforestation (Communications Earth & Environment)

Increased efficiency of water use does not stimulate tree productivity (Nature Climate Change)

Precipitation disaster hotspots depend on historical climate variability (Nature Communications)

Thanks for reading!

Louie Woodall

Editor