Source: nico_blue / Getty Images Signature

In this edition: 💰 Finance Researchers claim extreme weather wiped out US$2.7trn of market value from US corporates post-2005, climate risks threaten to overwhelm insurers of global supply chains & more. 🏛️ Policy Biodiversity loss and ecosystem collapse threaten UK national security, UN’s “water bankruptcy” fears & more. 🤖 Tech Canada’s adaptation tech start-ups receive only 4% of climate venture capital, Tomorrow.io announces new satellite constellation & more. 📝 Research Another round-up of papers and journal articles on all things climate adaptation.

What I’m Thinking About This Week

Winter Storm Fern roared across the continental US last weekend, playing havoc with regional energy grids and sending businesses of all kinds into disarray. While the physical and economic toll of this monster blizzard is yet to come into focus, already Bank of America is saying it could drag on first-quarter GDP, crimping growth by 0.5 to 1.5 percentage points.

Escalating extreme weather events are the hallmarks of a changing climate. While the science on global warming’s contribution to more frequent and severe extreme cold events is weak — and the effect of greenhouse gases on the polar vortex responsible for last weekend’s frigid conditions uncertain — it is settled that overall, extreme weather events are becoming more common as the planet heats up.

Because of this, businesses and financial institutions should be looking for efficient ways to hedge their exposure and compensate for expected losses. At one point last weekend, icy temperatures forced 10% of US natural gas production offline, while on Sunday alone 11,400 flights were cancelled. Delta, American Airlines, and United stocks are all down over the last five days. These are the hits that companies should be looking to recover from using financial innovations. Sure, firms in commodities — like oil and gas — can hedge price swings tied to extreme weather using traditional futures markets. But that’s not the same as a contract that pays out a fixed sum if a specific event occurs within a set time frame.

Parametric insurance offers a more tailored solution. These are contracts that release cash when extreme weather conditions exceed predefined thresholds. Jamaica’s catastrophe bond offers an example of parametric insurance in action. Last year, Hurricane Melissa tore through the Caribbean island. The storm’s track and central pressure reached such a pitch that they set off the bond’s parametric triggers, leading to a US$150mn payout — invaluable to the country’s post-disaster rebuilding.

The thing is, catastrophe bonds are hefty instruments, generally used to hedge extreme weather risk to insurers, reinsurers, and (as was the case with Jamaica) sovereign governments. They’re not designed for tactical, event-driven hedging by businesses, even large multinationals. So what is?

How about event contracts? These have rocketed in popularity off the back of platforms Kalshi and Polymarket. Put simply, these instruments allow people to speculate on the outcome of a specific event — from the result of a political election to the winner of a football game. Most are structured as simple “yes” or “no” wagers, settling once the event concludes.

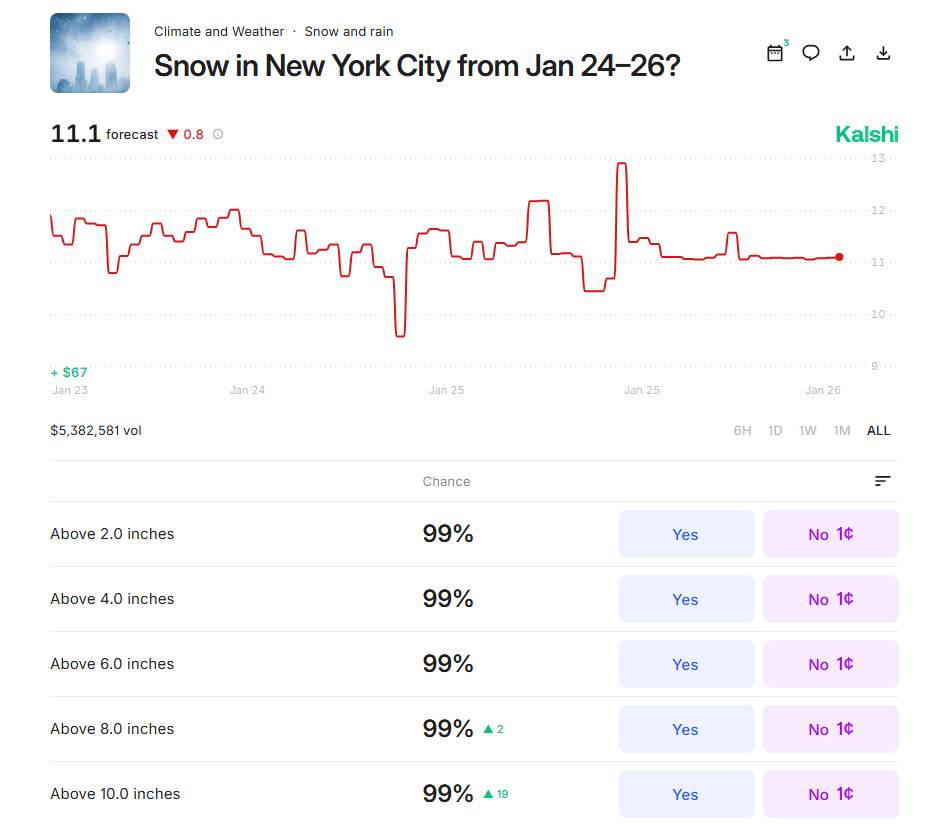

Now, it’s clear that the soaring popularity of event contract platforms is being fueled by sports betting. On Kalshi, volumes for “Pro Football Champion” (who will win the Superbowl) are above US$146mn. However, the platforms also offer contracts tied to weather events. Last weekend, Kalshi offered a host of contracts linked to the winter storm, allowing punters to bet on just how much snowfall, in inches, would cover New York City, among other places.

Source: Kalshi

In essence, these are tradeable parametric insurance contracts that can be bought and sold for tens, hundreds, and thousands of dollars — rather than the tens of millions typical for catastrophe bonds. Could this solve businesses’ extreme weather hedging needs? Right now, probably not. As Joe Weisenthal noted, the volumes for these weather contracts are tiny, and there’s not enough capital in them to serve as liquid hedging instruments for companies looking to cover cancelled flights or frozen pipelines.

One problem might be that Kalshi and Polymarket are clearly going all-in on the sports gambling market, with climate and weather contracts an afterthought. I don’t know for certain, but I doubt a sliver of the investment and human capital going into expanding parlays and other sports betting products is being used to encourage institutions to hedge weather risk. Another issue is that the climate and weather contracts currently available may not be useful for managing business interruption. Certainly, snowfall correlates somewhat with winter storm-related disruptions, but not if the contract is based off of the levels in Central Park. What matters is snowfall near the company’s assets. Even more important is temperature, which affects which assets are vulnerable to frost damage and which transport routes might get shut down.

Does this, then, suggest a gap in the market for a pure-play, climate-and-weather prediction market that brings businesses, hedge funds, proprietary traders, and speculators together to create a new kind of tradable parametric insurance? Undoubtedly. In fact, I wouldn’t be surprised if a stealth start-up is working on such a platform already.

If you’re out there, get in touch!

Louie Woodall

Editor, Climate Proof

📈 The road to 300: Climate Proof is closing in on 300 paying members. Each new member helps support our mission of bringing you the best adaptation finance, tech, and policy news and insights anywhere online. If you’re already a member thanks for the support — and consider referring us to friends and colleagues by forwarding this email. Not a member yet? Then upgrade here.

Extreme Weather Hits Firms Harder Than Expected, New Study Shows

A new AI-powered analysis finds that extreme weather events have wiped out US$2.7trn from publicly listed US companies since 2005, with the bulk of losses tied to direct damage to physical assets.

Researchers at the University of Zurich and Technical University Munich used large language models to sift through 1.7 million SEC filings and match reported impacts to 286 major US weather disasters. The approach reveals that one-in-five listed firms disclosed material damage linked to storms, floods, wildfires, and other hazards, many more than previously identified using traditional geospatial models.

The study distinguishes between direct asset damage and indirect economic disruptions like supply chain shocks or demand swings. Direct hits to assets inflicted the greatest financial pain, with average stock losses of 3.3% over the 60 days following a given event. However, indirect impacts were less severe but more frequent.

Cumulative Estimated Change In Firm Value By Extreme Weather Events From Non-Positive Impacts

Notably, some firms reported gains following extreme weather disasters — totaling US$327bn — typically in sectors like construction and retail that benefit from post-disaster demand surges. Yet the overwhelming trend was negative: across industries, especially manufacturing and finance, events like hurricanes and severe storms triggered lasting losses.

Industry and regional patterns diverged sharply from physical damage estimates. For example, New York suffered the biggest firm-level valuation losses due to the density of company headquarters. Conversely, Georgia and Nebraska saw net gains, driven by firms that profited from price shocks or supply disruptions.

In Brief

The European Union must invest €70bn (US$83bn) each year through 2050 to adapt to intensifying climate risks, according to a European Commission assessment. The analysis, the first to systematically quantify adaptation investment needs across the bloc, flags major funding gaps in infrastructure, ecosystems, and food security, in particular. France, Italy, Germany, and Spain have the highest demand for adaptation investment due to size and exposure. The report urges tighter integration of adaptation into national budgets and calls for improved data and scenario-based planning. Its release comes as the Commission readies a new climate resilience framework. (European Commission)

Climate-related disasters are increasingly overwhelming the insurance and reinsurance systems that support global supply chains, according to a new report from the Stockholm Environment Institute. The report warns that traditional insurance models are struggling to keep pace with rising climate risks, as the frequency and severity of extreme weather events trigger cascading disruptions across interconnected supply networks. Insured catastrophe losses have grown by 5-7% annually in recent years, prompting insurers to withdraw from high-risk regions and sectors. (SEI)

Natural catastrophes caused US$296bn in global economic losses in 2025, with over half uninsured, according to analysis by Gallagher Re. The year saw 58 billion-dollar events, 23 of which exceeded US$1bn in insured losses, driven by US wildfires and severe convective storms. While overall losses were below average, the volatility underscored the growing need for adaptation investment. In earlier analysis, Munich Re pegged 2025 insured losses at US$108bn and Swiss Re at US$107bn. (Gallagher Re)

Climate change may cut the global sport industry’s value by US$1.6trn by 2050, according to a new World Economic Forum report. The study, co-authored with Oliver Wyman, warns that extreme weather, pollution, and dwindling participation threaten core sectors like sports tourism and equipment manufacturing, particularly in Asia, where much of the gear is made. The sports industry is vulnerable to “accelerating environmental degradation”, the report says, but is also a “significant contributor to these pressures”. (New York Times)

The Nordic Development Fund pledged that at least 50% of all new financial commitments will target adaptation. Its ‘Strategy 2030’ plan also promises to focus on high-risk, early-stage investments in resilience-building projects with transformative potential, particularly through blended finance and private sector engagement. (Nordic Development Fund)

The Hong Kong Monetary Authority has released Phase 2A of its Sustainable Finance Taxonomy, expanding its framework to include climate change adaptation and transition finance. The move follows a robust consultation process and reflects strong market support for clearer, more practical guidance on classifying green and sustainable activities. (Hong Kong Monetary Authority)

Standard Chartered Bangladesh has teamed up with World Vision Bangladesh to roll out two climate resilience initiatives targeting some of the country’s most climate-exposed coastal zones. One program will support ecosystem restoration and resilient livelihoods around the Sundarbans — Bangladesh’s natural storm shield — while the other will deploy solar-powered water systems to combat saltwater intrusion and water scarcity in cyclone-hit districts. (The Business Standard)

Florida Attorney General James Uthmeier, together with other Republican-led states, sent a warning letter to climate non-profit Ceres, accusing the group of being the ringleader of a “climate cartel” pushing net-zero goals that they allege harm US families and businesses. The letter cites pressure campaigns on firms to divest from fossil fuels and boardroom interventions, and raises the possibility of legal action if Ceres continues. (Office of the Attorney General, State of Florida)

Climate Proof is the only media and intelligence platform dedicated entirely to the Adaptation Economy.

We are supported by paying members, who besides the warm and fuzzy feeling that comes with backing independent media, also get access to in-depth features, the Climate Risk Signals Explorer, and the Adaptation10 series (among other perks).

We’re at 259 paying members right now, and would love, love, love to get to 300 before the end of January.

So come on, get loads more adaptation insights and help support a scrappy media start-up by smashing the upgrade button below👇

With thanks,

Louie Woodall

Editor

UK Warns of National Security Risks from Global Ecosystem Collapse

Biodiversity loss and ecosystem collapse pose a mounting threat to the UK’s national security, according to a new assessment by the UK government.

The report — which was supposed to have been published last fall but was blocked by the Prime Minister’s office — finds that degradation across every major ecosystem is already driving global crop failures, disease outbreaks, and extreme weather. Without intervention, these trends are “highly likely” to intensify through 2050 and beyond.

Biodiversity Loss Impacts And Feedback Loops

Ecosystem failure is forecast to trigger cascading security risks from mass migration, geopolitical conflict, and economic turmoil. As the report lays out, food insecurity alone increases migration rates significantly, while degraded ecosystems intensify resource scarcity, increasing the chances that organized criminal groups will compete for control. In vulnerable regions like Central America, collapsing agricultural systems are already displacing hundreds of thousands, a trend expected to accelerate globally.

The report stresses that technology alone cannot compensate for ecological collapse. While regenerative agriculture and nature-restoring innovations have promise, these require time, investment, and scaling. Meanwhile, ecosystem protection and restoration are more immediate, cost-effective solutions.

In Brief

The US National Science Foundation (NSF) is inviting “concepts” for restructuring the National Center for Atmospheric Research (NCAR), the country’s premier climate-and-weather hub, which the Trump administration is looking to shutter. In a Dear Colleague Letter issued January 23, NSF called for ideas on continuing the center’s atmospheric observational platforms, computing resources, and training programs in weather and space weather modeling. The consultation period closes on March 13. (National Science Foundation)

Many of the world’s water systems have entered a state of irreversible decline, a new report from the UN University Institute for Water, Environment and Health warns. Institute Director Kaveh Madani warns that much of the planet is facing “water bankruptcy” — a condition marked by ecological insolvency, where water is overdrawn or polluted beyond recovery, and irreversible damage to natural systems like lakes and wetlands. More than half of large lakes have declined since the 1990s and 35% of wetlands have been lost since 1970. Nearly three-quarters of the global population now lives in water-insecure countries, and drought impacts cost an estimated US$307bn annually. (UN News)

World Meteorological Organization Secretary-General Celeste Saulo called for increased investment in global weather and climate infrastructure at the World Economic Forum’s 2026 Annual Meeting in Davos. Saulo warned that the foundational systems supporting forecasts, early warnings, and risk models are under growing pressure from declining international coordination and other forces. (World Meteorological Organization)

Canada’s ‘Adaptech’ Market Low on Investment, Report Finds

Adaptation-focused start-ups in Canada account for 10% of the country’s climate tech sector but receive just 4% of climate venture capital, according to a new report from Tailwind Futures and MaRS Discovery District — pointing to a potential funding bottleneck for climate-proofing innovations in the country.

The analysis also underlines a lopsided allocation of investment across sectors. Nearly 90% of pure adaptation tech funding — CAD$608mn (US$444mn) out of CAD$706mn (US$515mn) — is flowing to ag-tech solutions, like precision farming and drought-resilient crops, while core adaptation sectors such as flood control and urban heat resilience remain capital-starved. “Adaptech” solutions with dual mitigation and adaptation benefits have fared better, attracting CAD$3.5bn (US$2.6bn) in total, largely in agriculture and industrial decarbonization plays.

Venture Funding For Pure-Play Adaptation Start-Ups

On the demand side, the data is mixed. While 96% of Canada’s largest listed companies recognize climate risks, only 11% report quantifiable adaptation investments. High-exposure sectors like mining and telecom are beginning to deploy capital, with TELUS’s CAD$125mn (US$91mn) five-year climate resilience financing commitment a standout example. However, it remains the case that adaptation still lacks the financial metrics and business models that unlock institutional capital. On the government side, demand for adaptation solutions is strong, with the report estimating CAD$1.2bn (US$880mn) in federal spending and CAD$995mn (US$726mn) in provincial and territorial allocations.

The report calls for public and philanthropic actors to crowd in private finance with early-stage catalytic investments, like milestone-based funding and blended finance vehicles. As for adaptation entrepreneurs, it urges them to embrace underexplored adaptation niches, where demand for solutions is high but spending has so far fallen short — like in smart metering systems, rainwater harvesting programs, and AI-powered climate risk assessments.

In Brief

Flood and climate risk modeler Fathom has released FathomDEM+, a new global terrain dataset that provides a credible, benchmarked view of terrain elevation worldwide. The new resource is trained on more than 10 million km² of high-resolution data, and includes the world’s largest LiDAR collection — a laser-based method for measuring distances to surfaces. The dataset is being used to inform Fathom’s next generation of global flood maps, and is also available as a standalone tool for climate adaptation, flood risk modeling, and infrastructure design. (Fathom)

Weather-tech firm Tomorrow.io has announced DeepSky, which it claims to be the world’s first AI-native, space-based weather-sensing constellation. DeepSky will use a proliferated low-Earth orbit (pLEO) network of multi-sensor satellites to make the atmosphere and oceans continuously observable in real time, enabling faster, more accurate predictions of extreme weather. (Tomorrow.io)

Axa’s Digital Commercial Platform has inked a major deal with ICEYE, gaining access to the satellite operator’s unique assortment of synthetic-aperture radar (SAR) data to augment its climate risk intelligence capabilities. The move enables Axa to monitor floods, wildfires, and other natural catastrophes in near real-time — even in darkness or obscured conditions. The partnership bolsters Axa’s push to shift from disaster response to predictive, preventative risk management amid rising climate-related threats. (ICEYE)

Earthmover has launched an online marketplace for AI-ready weather and climate data, offering instant, analysis-ready access to an array of datasets from providers like Brightband, Dynamical.org, and Zeus AI. Built around the open-source Icechunk format, the platform enables real-time updates and plug-and-play integration for sectors from energy to insurance. (Earthmover)

A new international initiative aims to enhance climate resilience and food security in West Africa by applying artificial intelligence to weather forecasting. Funded by the Gates Foundation and the UK’s Foreign, Commonwealth & Development Office, Project Cumulus will bring together researchers from the Alan Turing Institute, the University of Cambridge, and the University of Leeds with meteorological agencies and universities in Ghana and Senegal. The project will use AI models to develop forecasting systems tailored to local weather conditions, which are often poorly served by conventional models. (Alan Turing Institute)

Snack company Mondelēz International has opened applications for its 2026 CoLab Tech accelerator, an initiative looking to support start-ups focused on climate resilience and agricultural innovation. The program seeks companies advancing technologies to protect key supply chains — like for cocoa and wheat — via regenerative practices, emission reductions, and high-efficiency fermentation. Up to 10 start-ups will receive virtual mentorship, commercialization support, and potential product pilots. (Mondelēz International)

RESEARCH

Quantifying heat exposure and its related mortality in Rio de Janeiro City: evidence to support Rio’s recent heat protocol (medRxiv)

Spatial-temporal evolution analysis of the impact of climate change adaptation policy on industry chain resilience (Humanities & Social Sciences Communications)

Climate adaptation policies in Central Asia overlook mental health (Scientific Reports)

Thanks for reading!

Louie Woodall

Editor