Source: Caio Cezar / Pexels

Event Tomorrow!

🏬 WEBINAR — Closing the Climate Adaptation Gap: How AI Can Connect Cities, Investors, and Innovators

Join the Cornell Tech Urban Tech Hub, in partnership with Climate Proof, for a preview of Resilience Scanner, a new platform documenting how cities worldwide are using technology to adapt to climate change. This webinar will bring in climate adaptation investors, scholars, and practitioners to explore how AI-powered deep research can help close this gap and unlock opportunities for faster, more effective urban climate adaptation.

⏰ February 10, 2026, 02:00pm Eastern Standard Time

In this edition: 💰 Finance Academics, scientists blast “flawed” climate-economic models, LendingTree’s health check of US home insurance markets & more. 🏛️ Policy Europeans’ household and neighborhood resilience measures found wanting in EEA survey, California state senator backs climate change lawsuits of fossil fuel giants & more. 🤖 Tech Tomorrow.io bags US$125mn for DeepSky satellite constellation, UK government backs overhaul of agri-data & more. 📝 Research Another round-up of papers and journal articles on all things climate adaptation.

What I’m Thinking About This Week

Product-market fit is the bane of start-ups. A good idea is one thing, but what makes an idea commercially viable is the degree to which it meets a strong market demand.

Adaptation technology (or ‘adaptech’ as those crazy kids at MaRS are calling it) appears particularly challenged by the product-market fit problem. Yes, it’s clear that climate change is affecting, and will continue to affect, all kinds of economic activity. But it is not clear these shifts are translating into cogent demand signals. In fact, both ends of the signal chain — the transmitter and the receiver — seem a bit faulty.

Over on Bloomberg, Jenn-Hui Tan — Chief Sustainability Officer at investment house Fidelity International — claims that the “the return on investment of resilience or adaptation is harder to identify than for mitigation”. This suggests a clear demand signal isn’t being transmitted. That’s backed up by data from Tailwind Futures and Vibrant Data Labs, which show early-stage capital barely trickling into adaptech. Capital follows performance — and right now, the numbers suggest adaptech is struggling to communicate its value to investors.

Pure-play Adaptation Start-Ups Make Up 12% Of All Climate Tech Start-Ups But Receive Only 3% Of The Funding (Data From December 2024)

Perhaps this has something to do with the adaptech solutions being proffered — and issues at the other end of the signal chain. Maybe founders are not receiving the right messages from businesses, governments, and other consumers on the adaptation solutions they’re looking for?

While there’s certainly plenty of information being broadcast, the loudest voices are not necessarily proving the most useful. For example, the European Environment Agency recently claimed that three sectors — agriculture, energy, and transport — need a combined €53-137bn of annual investment for climate-proofing. However, it offered nothing on what this money should actually be spent on. Even thorough reports like McKinsey Global Institute’s mapping of adaptation costs fall short. Of the 20 measures they analyze, most involve generic infrastructure or public policy interventions — things like cooling shelters, sea dikes, and stormwater systems — that are not the kind of solutions private-sector adaptech providers can easily deliver.

Should the messengers take some share of the blame? Public agencies and major consultancies may be making the case for adaptation, but to my mind not in a way that is helpful for would-be adaptech entrepreneurs. Often, agency mandates prohibit them from telegraphing a preference for one solution over another. Meanwhile, consultancies tend to promote solutions they — or their clients — already have ready to sell.

Fortunately, these entities do not have a monopoly on adaptation messaging. A clutch of independent specialists are putting the hard yards in crafting focused analyses of specific adaptation niches that could help emerging entrepreneurs crack the ever-challenging product-market fit. A new favorite of mine in this genre comes from Adaptation Alpha, by Gwyneth Fries. She writes market scans and investment analysis of promising adaptation opportunities. Her recent probe of the US$20bn opportunity in US private flood insurance is a case in point.

Then there are new tools, like the Resilience Scanner out of Cornell Tech’s Jacobs Institute (a webinar on which you can attend by clicking the link above). This web app pulls real-world adaptation solutions from case studies across 980 cities worldwide. But more than that, it recommends solutions for cities based on what’s worked in other, similar conurbations — signaling to adaptech entrepreneurs where they might find fertile ground for their ideas.

Yes, it’s true that some of the listed solutions again tilt towards infrastructure and public interventions rather than obviously commercial enterprises — or consist of bundles of projects where it’s hard to draw out discrete tech applications. Still, in its coverage of cities and specificity of solutions, it is far more useful than yet another report detailing the adaptation investment gap.

Here’s hoping a whole new wave of messengers rises to better amplify the adaptation imperative, and help solve the product-market fit problem that’s holding back adaptech today.

Louie Woodall

Editor, Climate Proof

Flawed Economic Models Undermine Climate Risk Management and Adaptation Planning, Report Warns

Financial and policy institutions may be underestimating the scale and complexity of climate damages due to outdated and oversimplified economic models, a new report claims.

Written by the non-profit Carbon Tracker and the University of Exeter’s Green Futures Solutions unit, Recalibrating Climate Risk argues that current GDP-centric approaches to modeling climate impacts fail to capture structural shifts to economies and underplay extreme weather impacts, like the 2021 Texas winter storm. Events like these barely register in models preoccupied with mean temperature changes, but cause many billions in real-world damages.

Conventional damage models treat climate change as a marginal disruption to growth, assuming that economies will continue to expand even as warming intensifies. This assumption, the report argues, masks the possibility of climate tipping points rapidly restructuring the biosphere and transforming the context of economic and financial activity. These models also underplay local or regional extremes that cause significant losses where they occur, but barely dent global GDP.

Then there is their failure to address the cascading effects from climate shocks that propagate through food systems, migration, conflict, and financial networks.

Perceived Adequacy Of GDP And Expert-Identified Additional Metrics

For regulators and adaptation planners, these blind spots pose serious challenges. Financial institution stress tests and disclosure requirements based on models calibrated to mean temperature pathways and smooth damage curves risk grossly understating the true vulnerability of banks and insurers. The report calls for scenario models that reflect extremes, second-order effects, and the growing uncertainty at higher warming levels. It urges central banks and supervisors to abandon their reliance on narrow GDP losses and adopt more comprehensive measures that capture system-wide fragility and adaptation thresholds. In particular, experts surveyed for the report cited the need for metrics that capture inequality, distributional losses, non-market damages, and physical destruction.

The authors’ findings also have implications for adaptation finance. They warn that current estimates often blur the line between spending that addresses slow-moving exposure and spending meant to guard against abrupt shocks. “Where damages arise from sudden extremes that irreversibly destroy capital and propagate through interconnected supply chains, adaptation spending risks becoming reactive repair rather than resilience, or in some cases a misallocation of scarce capital,” they write.

In Brief

Winter Storm Fern inflicted an estimated US$6.7bn in privately insured losses across more than 30 states, according to Karen Clark & Company’s flash estimate. The January event blanketed the US east of the Rockies in snow, ice, and record-breaking cold, with Texas and Tennessee suffering the highest losses. Freeze was the main driver of damage, particularly in southern states unprepared for extreme cold. Prolonged power outages and plunging temperatures led to widespread burst pipes, especially in commercial buildings, where inactive heating systems left plumbing systems vulnerable. Commercial claims are expected to outweigh residential ones due to both exposure and size. (Karen Clark & Company)

US home insurance markets are becoming increasingly unstable as rising disaster losses and construction costs cause abrupt premium hikes in climate-exposed states, according to a new LendingTree analysis. New England states including Massachusetts, Vermont, and New Hampshire were the most stable from 2020 to 2025, with relatively low insurance rate growth, low uninsured levels, and manageable household insurance costs. By contrast, Louisiana, Iowa, and Arkansas ranked as the least stable, with loss ratios exceeding 100% and about one in five homes uninsured, signaling growing strain on insurers and homeowners alike. (Lending Tree)

California’s insurer-of-last-resort is again turning to Wall Street to help cover the rising cost of wildfires. The California FAIR Plan Association is aiming to raise at least US$200mn through a new catastrophe bond that will provide backup funding if wildfire losses top UA$5bn. This is the FAIR Plan’s second bond deal, following a record-setting US$750mn bond issued in December. (Artemis.bm)

The UK is set to cut climate finance for vulnerable countries by more than 20% — from £11.6bn (US$15.9bn) to £9bn (US$12.3bn) over five years — a real-terms drop of nearly 40%. Spending restrictions imposed by the Treasury have been identified as the cause, along with a shrunken overall aid budget. Civil servants are also reportedly reclassifying unrelated aid projects as climate finance to plug gaps, raising transparency concerns. (The Guardian)

Southeast Asia is woefully underfunding adaptation, despite the region bearing some 40% of global climate-related losses from 2000 to 2023, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA). Adaptation received just 12% of the region’s total climate finance between 2018 and 2019. Moreover, funded projects face a long road to approval, and disbursement rates are low due to poor data and challenges articulating adaptation’s theory of change. The report urges governments to integrate adaptation into national development plans and budgets and strengthen technical criteria in sustainable finance taxonomies, among other measures. (IEEFA)

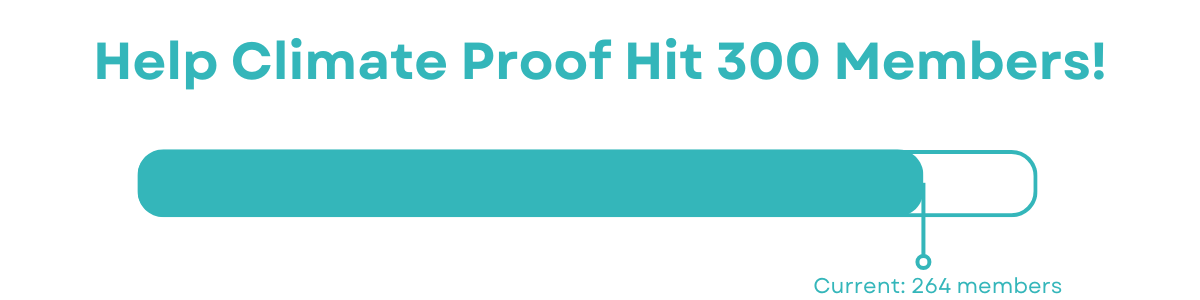

Climate Proof is the only media and intelligence platform dedicated entirely to the Adaptation Economy.

We are supported by paying members, who gain access to in-depth features, unique data products, and events.

We’re only 36 new members away from 300 total.

Will you be the one to take us over the top? 👇

With thanks,

Louie Woodall

Editor

Most Europeans Say They’re Hit by Climate Change. Few Have the Tools to Cope

More than 80% of Europeans say they’ve felt the effects of climate change in the last five years — most commonly, excessive heat at home, work, or in the streets. But according to a major new survey by the European Environment Agency (EEA) and Eurofound, household and neighborhood-level resilience measures are not keeping pace.

Of the 27,000 people surveyed, one in five said they did not have any household measures in place to guard against extreme weather. Just under half of respondents had shading at home, and fewer than a third had air conditioning or ventilation, despite heat being the most commonly described hazard. Nearly half of respondents said they had felt too hot in their home, work, or place of education.

Adoption Of Household Climate Resilience Measures: Highest & Lowest Percentage Of Measures In Place By Age Group

While many local governments have rolled out ‘soft’ adaptation measures like heat warnings and awareness campaigns, the report finds these are far more common than ‘hard’ infrastructure like cooling centers or flood defenses. Less than a quarter of respondents had seen flood prevention measures in their area, and an even smaller proportion said they’d observed cooling centers. Rural areas, which tend to be more self-reliant in household adaptation, lag cities in access to government-led measures.

This inequality in adaptation shows up across socioeconomic lines, too. Two-thirds of those struggling financially said they couldn’t afford to keep cool during summer, compared to just 9% of the financially secure. Renters and people in poor health also reported fewer resilience measures and greater exposure to impacts.

In Brief

Hawaii Governor Josh Green wants to plow US$126mn a year from the state’s new tourism-funded “green fee” into climate resilience and environmental protection projects. Proposals include beach restoration in erosion-prone areas, wildfire prevention, drought and water planning, invasive species control, reforestation, hurricane retrofits for homes, and workforce development tied to climate resilience. The state House and Senate will now review the proposals and choose which to move forward. (Honolulu Civil Beat)

California State Senator Scott Wiener has introduced legislation that would allow the Attorney General to seek damages from fossil fuel companies for climate-driven disaster losses. The proposed Affordable Insurance and Recovery Act comes as rising wildfire and flood risks push insurers to raise rates or withdraw coverage, driving more homeowners into California’s FAIR Plan, the state’s insurer of last resort. Supporters say the measure could help stabilize insurance markets and reduce premium pressures by shifting some climate-related costs away from policyholders. (Senator Scott Wiener)

Thousands of owners and managers of historic parks and gardens across the UK are being urged to take part in a new survey assessing climate impacts on the nation’s 2,700+ registered landscapes. Historic England and partners warn that droughts, floods, pests, and violent storms are already threatening iconic sites, yet guidance for climate adaptation remains limited. The research will shape future support under the Heritage 2033 strategy, identifying gaps in resources and resilience planning. Responses are due by March 26. (UK Heritage Fund)

Tomorrow.io Secures $175mn to Scale AI-Native Weather Satellite Network

Weather tech start-up Tomorrow.io has raised US$175mn to finance DeepSky, its AI-native weather satellite constellation — which it claims can dramatically improve forecasting and climate risk preparedness.

The equity round, led by Stonecourt Capital and HarbourVest, will accelerate the company’s rollout of a high-frequency, low-Earth orbit sensing network that should enhance global atmospheric observation and provide timely data to AI-enabled forecasting models.

Tomorrow.io has already launched its first 13-satellite constellation. This next phase with DeepSky is intended to improve revisit rates — shortening the time between observations of the same area — expand coverage in poorly-observed regions, and speed up the supply of data to global and regional weather forecasters, helping bolster decision-making in sectors from aviation to disaster response.

Source: Lorens93 / pixabay

Tomorrow.io’s tech is already used by over 250 organizations to enable supply chain optimization, assist with resilience planning, and power early warning systems.

Partners say Tomorrow.io’s capabilities allow for heightened resilience planning. “Operational resilience now depends on treating atmospheric data with the same rigor as any other mission-critical infrastructure,” said Nikhil Ahuja, Senior Director, Planning and Supply Chain at Amazon. “The advancement in sensing and rapid refresh frequency DeepSky enables creates a new class of AI-driven decision systems that are more adaptive and localized. This evolution will define the future of the world’s largest-scale operations.”

In Brief

Apeiron Labs has raised US$9.5mn to expand its fleet of ocean-faring robots, capable of gathering data climate-exposed sectors like fisheries, offshore wind, and coastal resilience planning. The startup’s three-foot-long AUVs dive up to 400 meters, collecting temperature, salinity, and acoustic data once or twice daily. The financing round was powered by Dyne Ventures, RA Capital’s Planetary Health arm, and S2G Investments. (TechCrunch)

The UK government has commissioned an Arup-led consortium to design and pilot new data sharing infrastructure for the agri-food sector, aiming to standardize information and rebuild trust to support climate action. Together with the Department for Environment, Food and Rural Affairs (Defra) Food Data Transparency Partnership, the project will develop common data standards and governance models to enable reliable measurement, reporting, and verification of environmental impacts across supply chains, with pilots testing applications such as digital product passports and smart data services. (Open Data Institute)

The UK Met Office has made its 2km and global 10km deterministic weather forecast datasets publicly available on Microsoft’s Planetary Computer, including a two-year archive totaling over 600 terabytes. The release gives researchers, developers, and policymakers streamlined access to authoritative weather data, which can be used to power large-scale analysis and train AI models for forecasting and early warnings of extreme events. (UK Met Office)

SP Ventures has landed an US$8mn investment from the Soros Economic Development Fund to expand AgVentures Fund III, its US$80mn vehicle backing early-stage agtech and climate-tech startups across Latin America. The fund is focused on scaling regenerative, low-carbon food systems, while improving some 500,000 rural livelihoods. (Soros Economic Development Fund)

RESEARCH

Anthropogenic climate change drives rising global heat stress and its spatial inequality (Nature Communications)

Predicting instabilities in transient landforms and interconnected ecosystems (Nature Communications)

100m climate and heat stress data up to 2100 for 142 cities around the globe (Data in Brief)

A decade of weather anomalies and natural disasters and their influence on environmental beliefs and actions across Australia (Journal of Environmental Psychology)

Towards resilient renewable energy deployment in Africa through a weather-aware optimization framework (npj Clean Energy)

Wildfire smoke PM2.5 and mortality rate in the contiguous United States: A causal modeling study (Science Advances)

Stakeholder preferences and perceived effectiveness of coastal adaptation measures in Seychelles (npj Climate Action)

Thanks for reading!

Louie Woodall

Editor