London skyline. Source: photocluster / Canva Pro

Event Announcement

Just FOUR DAYS to go before Europe’s top corporate climate adaptation event!

Join Climate Proof, DSR & Partners, and a rich array of corporate adaptation professionals this week for Corporate Climate Adaptation on October 30/31.

You can take part in-person in Düsseldorf or online — where Climate Proof editor Louie Woodall will be moderating the virtual sessions.

Get tickets HERE

In this edition: 💰 Finance UK Climate Financial Risk Forum debuts ‘From Risk to Resilience’ guide, Mediterranean leaders call for more EU adaptation finance & more. 🏛️ Policy UN publishes review of National Adaptation Plan progress, World Meteorological Organization urges AI inclusion in early warning systems & more. 🤖 Tech Burnt Island Ventures raises US$50mn for water tech, Arcadis launches climate risk platform & more. 📝 Research Another round-up of papers and journal articles on all things climate adaptation.

UK Regulators Push Financial Sector to Operationalize Climate Resilience

The Climate Financial Risk Forum (CFRF), a joint initiative by the UK’s Financial Conduct Authority and Prudential Regulation Authority, released a fresh batch of reports last week on embedding climate adaptation into financial decision-making and assessing physical risk data vendors.

The headline report, From Risk to Resilience, outlines how financial institutions can operationalize adaptation across asset classes, sectors, and sovereign exposures and capitalize on opportunities investing in climate resilience.

It updates the CFRF’s Aim–Build–Contingency (ABC) framework, first introduced by the forum in 2024, and introduces a raft of recommendations and examples on incorporating adaptation into financial institution’s climate transition plans and crafting adaptation-focused financial products.

UK Climate Financial Risk Forum Symposium 2025. Source: Alex Kennedy / LinkedIn

UK banks Standard Chartered and Natwest contributed to the report, alongside asset managers including Schroders and Columbia Threadneedle and insurers like Zurich and Avivia.

The ABC framework encourages financial institutions to use a range of forward-looking climate scenarios to inform investment decisions: one ‘aiming’ for a 1.5°C warming future, another ‘building’ for 2°C, and a third ‘contingency’ scenario anticipating 2.5°C. The idea is that this allows investors to gauge the overall resilience of potential assets to a broad spectrum of possible extreme weather shocks and slow-onset events.

A second CFRF publication addresses practical implementation hurdles. This benchmarking study of 13 physical climate risk vendors — including Climate X, Jupiter Intelligence, Fathom, and First Street — reveals wide disparities in risk modeling, and urges financial institutions to tighten vendor selection and due diligence. Among the issues highlighted, the report cites the lack of standardized metrics used across providers and the challenges the face capturing systemic climate impacts on food systems, health, migration, and other themes.

The CFRF also published a training-focused report identifying key climate risk skills gaps among financial professionals, and a bundle of case studies on climate scenario analysis, complete with quantitative examples of how adaptation and chronic physical risks can weigh on sovereign and corporate financial profiles.

In a nod to nature-related risk, the forum released an additional handbook on integrating biodiversity loss into financial assessments, exploring how climate and nature risks can amplify each other and cause systemic shocks.

The CFRF intends for these publications to help the financial sector better manage climate-related risks and opportunities. However, they do not represent binding regulatory guidance or necessarily reflect the views of the UK’s financial watchdogs.

In Brief

The incoming president of COP30, André Corrêa do Lago, has called on countries to increase the quantity and quality of adaptation finance at the upcoming Belém summit, citing some nations’ demands that current levels be doubled or even tripled to meet existing needs. In his latest letter to the international community, dated October 23, Corrêa do Lago warned that adaptation remains underfunded and undervalued, even while 887 million people in poverty-stricken regions grapple with major climate hazards. He further called on countries to innovate with tools like resilience bonds, blended finance, and debt-for-resilience swaps. “Elevating adaptation … requires a strategic mix of financial instruments and stronger international cooperation,” he wrote. (COP30)

Leaders of nine Southern European nations urged Brussels to ramp up climate adaptation investments and fast-track funding rules during the MED9 summit in Slovenia last Tuesday. Citing escalating impacts from heatwaves, wildfires, and floods, the group — made up of Croatia, Cyprus, France, Greece, Italy, Malta, Portugal, Slovenia, and Spain —called for resilience to be embedded in EU defense and security strategies. Spain’s Prime Minister, Pedro Sanchez, called for 15% of defense budgets to be earmarked for climate and civil protection, while Portugal’s leader pushed for streamlined access to adaptation financing. (DWS News)

A US federal judge blocked the Trump administration from cutting more than US$9mn in climate resilience grants to Washington state, ruling that the sudden terminations were likely unlawful. The funding, allocated to the state by the National Oceanic and Atmospheric Administration under the Biden administration, supported programs to train over 2,100 students in climate resilience and reduce coastal and health disparities in vulnerable communities. US District Judge Marsha Pechman said halting the grants midstream would create “unnecessary chaos” in federally funded projects, noting Congress’s ongoing mandate to bolster climate preparedness. (Washington State Office of the Attorney General)

A new analysis by the Energy and Climate Intelligence Unit finds that UK food items hit hardest by extreme weather — including coffee, chocolate, butter, milk, and beef — are rising in price four times faster than other foods, driving up inflation. Prices for these climate-impacted foods jumped 15.6% on average in the year to August 2025, compared to 2.8% for other items. The report links the surge to droughts, floods, and heatwaves affecting major producers from Brazil to West Africa and the UK itself, rather than domestic policy changes like wage hikes. (Energy & Climate Intelligence Unit)

More than 30 major investors managing over US$3trn in assets have signed the Belém Investor Statement on Rainforests, urging governments to halt and reverse deforestation by 2030. The petition, signed by institutions including Pictet Group and DNB Asset Management, comes against a backdrop of accelerated forest destruction — with over 8 million hectares of forest having been lost in 2025 alone because of agriculture and fires. Signatories say financial risks to their portfolios are on the rise as natural systems, like forests, degrade, and support stronger legal and policy frameworks to ensure forest protection. (Belém Investor Statement on Rainforests)

Norges Bank Investment Management, Norway’s sovereign wealth fund, has released a 2030 Climate Action Plan with a sharper focus on physical climate risk, adaptation, and nature loss. This commits the fund to foregrounding “physical climate risk, adaptation and resilience and the intersection with nature” in client engagements, and to investment strategies that “eliminate deforestation and conversion of natural ecosystems.” (NBIM)

The African Development Fund has approved an additional US$8.6mn grant for Burundi’s Water Sector and Climate Resilience Building Support Programme, bringing total financing to nearly US$22mn. The initiative aims to deliver safe drinking water to 500,000 people across five drought- and flood-prone provinces, while expanding sanitation and resilience-oriented job opportunities. Funded projects include 17 solar-powered water systems, climate-smart irrigation, and eco-friendly sanitation. (African Development Bank Group)

💰 Creating Quality Content Is Expensive. Becoming A Climate Proof Member Isn’t

As you may have noticed, Climate Proof is on a hot streak right now. We’ve published hours of podcast content off the back of Climate Week NYC, upgraded our Climate Risk Signals Dashboard, and continued to pump out special features on everything from utilities adaptation to the latest in the US Climate Superfunds fight.

This kind of adaptation intelligence — the kind that gives practitioners a competitive edge — doesn’t come cheap.

That’s why we’re asking free subscribers to consider making the leap to a paid subscription today. It’s only $9/month or $89/year.

💸Want to support us? Then smash that upgrade button now!👇

With thanks,

Louie Woodall

Editor

Adaptation Plans Stall Amid Finance Bottlenecks

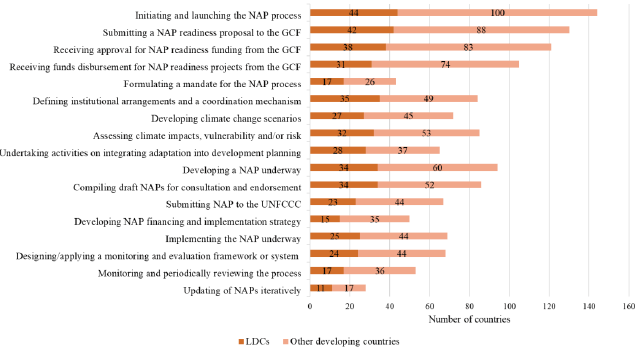

Only half of the low-income parties in the UNFCCC have submitted their National Adaptation Plans (NAPs) so far — raising concerns that many may miss the year-end deadline.

A new report on the global process finds that as of September 2025, 67 developing countries — among them 23 least developed countries (LDCs) and 14 small island developing states (SIDS) — have formally submitted NAPs to the UN. Another 77 have started the NAP process but have yet to complete their plans.

NAPs are meant to help countries defend against climate shocks and expand their adaptive capacity. The UNFCCC first signed off on the NAP process at the 2010 COP summit in Mexico, and developing country parties were called on to submit their plans by the end of this year at the 2023 conference.

One stumbling block for countries that have yet to submit is a lack of finance. Although the Green Climate Fund (GCF) has approved US$6.9bn for 116 projects aligned with NAPs, access to finance is uneven and slow. Capacity constraints and bureaucratic hurdles continue to delay the flow of funds, the report says, with only 58 of the 67 countries with submitted NAPs having secured GCF-backed projects.

While other sources of financing through the Least Developed Countries Fund and the Adaptation Fund are available, the report explains that many LDCs have not yet tapped their full allocation. As of September 30, no country had reached the cap of $40mn from the Adaptation Fund, for instance.

Experts say this funding issue makes the case for a strong adaptation financing agreement at COP30. “We need a decisive ratcheting up of ambition in adaptation finance, including a new adaptation finance target, the adoption of the UAE Framework for Global Climate Resilience indicators, and an overall move beyond fragmented, project-based interventions to fully financed, transformative implementation pipelines that deliver resilience benefits worldwide,” Ana Mulio Alvarez, Policy Advisor at think-tank E3G, told Climate Proof.

Measures Undertaken By Developing Country Parties On National Adaptation Plans*

Technical progress is more encouraging. Countries’ climate vulnerability assessments now increasingly use Earth observations and artificial intelligence for hazard monitoring. Early warning systems have also expanded globally — though many LDCs still lack comprehensive, multi-hazard systems.

However, in spite of these positive signals, the report stresses that adaptation implementation is still piecemeal, and lagging behind the pace of climate risks.

In Brief

The European Parliament rejected a proposal to reform the EU’s sustainability laws, delaying progress on key climate adaptation and mitigation disclosure rules for large companies. Lawmakers voted 318 to 309 against the compromise text for the so-called Omnibus I package, which would amend the Corporate Sustainability Reporting Directive (CSRD), the Corporate Sustainability Due Diligence Directive (CS3D) and the Taxonomy Regulation. The proposal, developed by Parliament’s legal affairs committee, aimed to narrow the scope of companies required to report sustainability data and ease obligations on climate transition plans. Its rejection sends negotiators back to the drawing board ahead of a new vote scheduled for November 13. (IPE)

Oil giant Exxon Mobil has sued California over its landmark climate disclosure laws, claiming they violate its free speech rights. The two measures, known as the California Climate Accountability Package, require large companies to report full greenhouse gas emissions and disclose climate-related financial risks starting in 2026. Exxon argues the laws force it to “trumpet California’s preferred message” and use flawed, speculative methodologies that misrepresent its role in global warming. The company also says the rules overreach by regulating out-of-state activities and doubling up on federal disclosure requirements. (New York Times)

Oregon Governor Tina Kotek signed an executive order directing state agencies to protect and restore 10% more of the state’s lands and waters within a decade. The measures target worsening drought, groundwater depletion, and river degradation threatening the state’s water security. (Oregon Governor’s Office)

The World Meteorological Organization (WMO) approved a package of measures to embed AI and machine learning into its global weather forecasting and early warning systems. The resolutions, passed at the group’s Extraordinary Congress last week, aim to fulfil its pledge to deliver early warnings to all by 2027. (WMO)

Water Tech Fund Closes $50mn Raise

US-based Burnt Island Ventures has closed a US$50mn second fund to back early-stage water technology start-ups, doubling down on a popular adaptation investment niche.

The fund targets innovations that address the intersection of aging water systems and intensifying climate impacts — as well as the surging industrial demand for water amidst the ongoing AI craze.

Founded by water industry veteran Tom Ferguson in 2020, Burnt Island Ventures has already fully deployed its first US$30mn fund across 18 companies, including Floodbase, Subeca, and SewerAI. The firm’s second fund will focus on seed-stage technologies for water reuse, digital efficiency, infrastructure resilience, and advanced treatment — areas increasingly seen as central to climate adaptation and business continuity.

Water treatment tank. Source: AvigatorPhotographer / Getty Images

The fund’s anchor investor is Xylem, a Fortune 500 global water solutions company. Other backers include climate-focused WovenEarth Ventures, whose managing partner Jane Woodward praised Burnt Island as a “thematic expert on a highly underestimated theme.”

The World Wide Fund for Nature estimates the water market to be US$1.6trn in size, and critical to roughly 60% of global GDP. Despite this, Ferguson says it has long lagged in venture investment. “Fund II allows us to double down on our mission of finding, funding, and scaling the most ambitious founders who are solving water’s most pressing challenges, as well as giving them the sector-specific expertise and network they can’t get anywhere else,” he said.

In Brief

Non-profit Climate Central has resurrected the US Billion-Dollar Disasters dataset, a key tool for tracking the rising financial toll of extreme weather, after the National Oceanic and Atmospheric Administration (NOAA) discontinued it earlier this year. Now led by former NOAA scientist Adam Smith, the analysis reveals that the first half of 2025 saw a record-breaking US$101.4bn in damages from 14 major disasters — far above the 46-year average of nine events annually. The January LA wildfires alone caused over US$60bn in damage, becoming the most expensive wildfire in US history. (Climate Central)

Global engineering consultancy Arcadis has launched Climate Risk Nexus, a digital platform designed to help companies understand climate risks and make informed investment decisions. The tool integrates global climate data with client-specific asset and operational inputs to support resilience planning across sectors. (Arcadis)

Geonengineering start-up Stardust Solutions has raised US$60mn in the largest-ever funding round for a company pursuing solar geoengineering, a process where reflective particles are sprayed into the atmosphere to cool the planet. The latest round was backed by Lowercarbon Capital and Exor, the investment house of Italy’s Agnelli family. The company, founded by two former Israeli nuclear physicists, says it has developed a process that mimics volcanic cooling effects without harming the ozone layer or ecosystems, and plans controlled outdoor tests by April. (Politico)

Dutch agrifood data platform TRACT has raised €18.6mn (US$21.7mn) in Series A funding to expand its supply chain intelligence platform globally to food companies facing mounting climate and regulatory pressure. TRACT helps major consumer packaged goods companies and commodity traders map their supply chains and manage sourcing risk, while ensuring compliance with rules such as the EU Deforestation Regulation. Investors in the round include Rabo Investments, Invest International, Pymwymic, and Working Capital Fund. (TRACT)

AI-powered food supply chain platform Mondra has raised £10mn (US$13.3mn) in Series A funding led by AlbionVC and Planet A Ventures to expand across Europe and strengthen its UK presence. Backed by retailers including Tesco, Lidl, Aldi, and Co-op, Mondra uses digital twin technology to map and monitor complex food supply chains, helping companies to manage climate risks and strengthen resilience. The new funding follows last year’s £3.4mn (US$4.5mn) pre-Series A and the launch of Sherpa, Mondra’s AI assistant for net zero decision-making. (Mondra)

Artificial intelligence models are providing more accurate predictions for the future of coral reefs, according to a new study published in Coral Reefs by the Wildlife Conservation Society. The study found that machine learning tools, trained on decades of field and satellite data, outperform traditional climate models. This is because they are better at capturing the complexity of reef ecosystems and the influence of local environmental factors. While many reefs face serious threats from climate change, the research indicates that others may remain stable or recover, particularly where local pressures such as overfishing and pollution are managed effectively. (Wildlife Conservation Society)

RESEARCH

Transforming climate services with LLMs and multi-source data integration (npj Climate Action)

Unpacking Article 2.1(c): Conceptual and Political Dimensions of Climate-Consistent Finance under the Paris Agreement (Germanwatch)

Understanding the climate–nature nexus and its implications for the economy and financial system (Centre for Economic Transition Expertise)

Thanks for reading!

Louie Woodall

Editor