Aerial views of the damage caused by Hurricane Sandy to the New Jersey coast. Source: New Jersey Army National Guard

Event Announcement

Date: Wednesday, January 14

Time: 10-11 am ET (7-8 am PT | 3-4 pm GMT)

Location: Virtual

Climate shocks are rapidly altering the operating environment for global companies. Extreme heat, water stress, and infrastructure disruptions are increasingly affecting production capacity, worker safety, and financial performance. These impacts are also reshaping stakeholder expectations from customers, investors, and risk advisers, creating both operational challenges and strategic opportunities for cross-functional teams.

Join C2ES and Resilience First for a one-hour webinar examining key findings from our forthcoming report, Building Corporate Climate Resilience: Key Insights from the 2025 Corporate Climate Resilience Foresight Series, informed by six dialogues with senior corporate leaders across sectors.

Speakers include: Nick Faull (Head of Climate & Sustainability Risk | Marsh), Stephen Torres (Principal Manager, Integrated Planning and Climate Adaptation | Southern California Edison), Rick Cudsworth (Board and Executive Director | Resilience First)

In this edition: 💰 Finance BNEF analysis shows 42% of US counties face above-median climate risk and increasing home insurance costs, US Treasury withdraws from Green Climate Fund & more. 🏛️ Policy Congressional appropriators back sustained funding for climate, weather agencies, FEMA to lose 1,000 workers & more. 🤖 Tech SORA Technology raises US$2.5mn for AI- and drone-powered infectious disease control, UpRoot Capital makes first investment in Pests, Invasive Species, and Biological Threats vertical & more. 📝 Research Another round-up of papers and journal articles on all things climate adaptation.

What I’m Thinking About This Week

Last week saw the release of the latest US billion-dollar disasters dataset by Climate Central — a non-profit that resurrected the annual series after the National Oceanic and Atmospheric Administration (NOAA) stopped maintaining the database in May. The top-level figures were alarming: the US experienced 23 billion-dollar-plus calamities last year, with the average time between disasters a mere 10 days.

The dataset is good fodder for headlines. A billion is a big number, after all, and the rising trend of budget-busting disasters is a useful indicator of worsening climate risks — and the need for adaptation. Still, I question whether these annual tallies are effective at influencing climate-proofing actions by businesses and governments in the US.

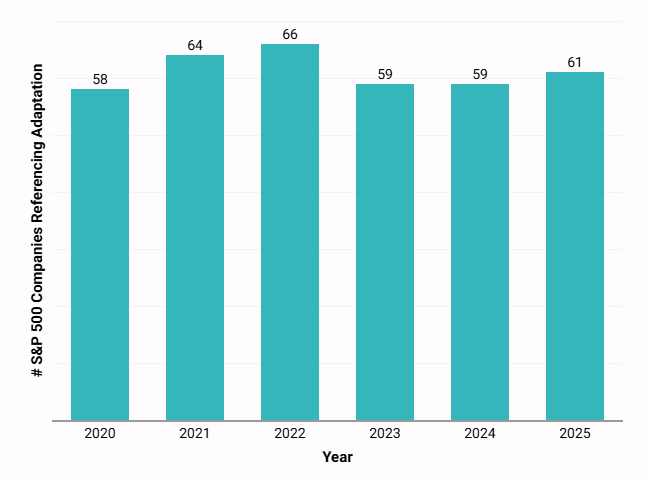

At the federal level, under the current administration the answer is clearly ‘no’, given its attempted gutting of NOAA, FEMA, and other climate and disaster response agencies. Meanwhile, relatively few large US corporates are referencing the importance of climate adaptation in their investor calls. Mentions of adaptation-related keywords (as recorded in the Climate Risk Signals Dashboard) have been stable over the last five years — despite this half-decade witnessing 138 billion-dollar-plus disasters.

Number Of S&P 500 Companies Referencing Adaptation-Related Keywords in Earnings Calls, By Year

There’s a quote widely misattributed to one of history’s greatest monsters that I feel underlines the inadequacy of large numbers as persuasive devices: “The death of one man is a tragedy, the death of millions is a statistic.” A reimagining of this aphorism for the climate adaptation context could be: “One billion-dollar disaster is a call to action, two dozen is an abdication of responsibility.”

So if large, aggregated loss numbers can’t do the job of persuading policymakers and business leaders of the importance of adaptation, what can? Maybe a classic journalistic trick could help. Take the national number, break it down to the household level, and frame it as a “tax” or similar burden. By that logic, the US$115bn in climate disaster losses the US saw in 2025 works out to about US$850 per household. We can then go further, taking the median income of US households into consideration, and say that last year’s calamities cost each household the equivalent of four days’ worth of earnings.

Now, of course this is a huge simplification. Losses aren’t distributed evenly across the US, and millions and millions of last year’s costs were absorbed by private insurance companies — impacting the wealth of their shareholders and hurting the wallets of their policyholders, rather than the population at large.

Still, a per-households, or even per-head, calculation of climate losses could prove a more useful heuristic for conveying climate-related losses — and therefore the value of adaptation — to decision-makers in government and business.

Louie Woodall

Editor, Climate Proof

💡 Last Call: Have your say on the Adaptation Turning Points of 2025 by completing the survey at the bottom of this newsletter!

Climate Risk and Insurance Costs Threaten Local US Budgets, BNEF Warns

Local governments across the US face a mounting fiscal time bomb as climate risk drives up insurance costs, threaten property values, and squeeze municipal budgets, according to a new BloombergNEF report seen by Climate Proof.

Nearly half of US counties — 42% — now face both above-median climate risk and increasing home insurance costs, with the most acute pressures in parts of California, Florida, New York, and Texas. In these areas, insurers are pricing in climate hazards more aggressively, or in some cases pulling back coverage entirely. Climate-driven disasters in such counties could devastate local property values, cutting off a major revenue stream for municipalities and threatening to shake the foundations of the municipal bond market.

Property markets are beginning to respond. BloombergNEF finds that homebuyers are increasingly favoring counties with lower climate risk, with “hot” markets — defined as those with home price growth at least 50% above the statewide average — concentrated in states like Oregon, Colorado, and Michigan. Conversely, high-risk “cold” markets, such as in Mississippi, are seeing slower growth — though only one-in-five of these markets are in high-risk areas. The report warns that counties combining high risk and fast growth, roughly 1% of the total, face particular fiscal exposure if a disaster causes house prices to fall and tax revenues to drop.

Source: VladTeodor / Getty Images Pro

That risk is heightened in regions that rely heavily on property tax revenues. In Texas, Kansas, and Nebraska, many counties derive more than 75% of their general revenue from property taxes, making them vulnerable to real estate downturns. The analysis also highlights the potential fallout from reduced federal disaster support, noting that the Trump administration’s proposals to scale back the Federal Emergency Management Agency (FEMA) could leave counties in the central US without a financial backstop. In Louisiana, 62 of 64 counties have received disaster aid totaling more than 40% of GDP in recent years.

BloombergNEF points to community resilience as a key moderating factor in the climate-finance risk cycle. Urban counties in the Northeast and Great Lakes regions generally show stronger resilience metrics due to better infrastructure and emergency preparedness, while rural counties in the South lag behind.

In Brief

The US endured 23 billion-dollar-plus weather and climate disasters in 2025, totaling US$115bn in damages, according to Climate Central — marking the third-worst year on record after 2023 and 2024. The wildfires that scorched Los Angeles in January were the costliest ever, racking up US$61.2bn in damages and doubling the previous record. Severe storms dominated the year with a record-breaking 21 events, including a deadly March tornado outbreak that killed 43 and caused US$11bn in losses. A heat-driven drought hit the West, and rapid-fire disasters continued to shrink recovery time between events — averaging just 10 days in 2025. Since 1980, the US has suffered 426 such disasters costing over $3.1 trillion, a toll driven by both intensifying extreme weather and rising exposure from development in high-risk areas. (Climate Central)

The US Treasury has formally withdrawn from the Green Climate Fund, ending American participation in the UN’s primary climate finance mechanism and vacating its Board seat. The moves follows the Trump administration’s broader exit from international climate agreements (see below). Treasury Secretary Scott Bessent criticized the GCF as a “radical” body misaligned with the administration’s focus on cheap, reliable energy for economic growth. (US Treasury)

Climate adaptation entered the mainstream of venture capital in 2025, according to data from Sightline Climate, which flagged the dawn of the “Adaptation era” in its latest investment trends report. Overall climate tech investment rose 8% to US$40.5bn last year, though deal count dropped 18% — reflecting an increased concentration of venture capital in fewer, bigger bets. Sightline said that key growth areas included wildfire prevention and the first serious venture bets on geoengineering. (Sightline Climate)

UK bank Standard Chartered launched its first-ever €1bn (US$1.2bn) green bond, with proceeds earmarked for climate-resilient infrastructure, renewable energy, and green buildings across Asia, Africa, and the Middle East. The issuance will support over 350 projects spanning ten climate themes, from water security to circular economy solutions. More than 70% of these assets are based in emerging markets, where the bank says its capital can deliver outsize decarbonization and adaptation benefits. (Standard Chartered)

❓Will You Be The One To Get Us To 300 Members?

Climate Proof is the only media and intelligence platform dedicated entirely to the Adaptation Economy.

We are supported by paying members, who besides the warm and fuzzy feeling that comes with backing independent media, also get access to in-depth features, the Climate Risk Signals Explorer, and the Adaptation10 series (among other perks).

We’re at 253 paying members right now, and would love, love, love to get to 300 before the end of January.

So come on, get loads more adaptation insights and help support a scrappy media start-up by smashing the upgrade button below👇

With thanks,

Louie Woodall

Editor

Congress Rebuffs Trump’s Planned NOAA, NASA Cuts

Congress rejected sharp cuts to climate and weather-related agencies proposed by the Trump administration in a newly unveiled 2026 spending package.

The US$467bn “minibus” of three bipartisan bills, passed by the House of Representatives last Thursday, includes budgets for the Departments of Commerce, Justice, Energy, and Interior, as well as NASA, the National Science Foundation (NSF), and the National Oceanic and Atmospheric Administration (NOAA). The legislation keeps the government open ahead of a looming January 30 shutdown deadline and sends a strong bipartisan signal in support of US climate resilience efforts. The Senate is due to take up the bills this week.

Agencies essential to climate science and adaptation avoided deep funding reductions floated by the White House last year. Under the “minibus”, NOAA — the backbone of federal weather and climate forecasting — would retain near-level funding at US$6.1–6.2bn. According to Senate Democrats, this includes US$1.46bn for weather prediction improvements and a US$10mn increase for local forecast office staffing, a response to bipartisan concerns over prior shortages. In addition, US$1.67bn would be earmarked to maintain the current generation of NOAA weather and climate satellites and to invest in next-generation satellite capabilities.

Source: Trev W. Adams / Pexels

NASA’s budget would be trimmed only slightly to US$24.4bn, far better than the 24% cut proposed by the Trump administration. Notably, US$2.2bn would be allocated to NASA’s Earth Science division, which provides vital data for climate risk and adaptation — directly opposing Trump’s call for a 53% cut.

This funding would support NASA’s Earth System Observatory missions, which promise improved monitoring of climate change and natural hazards, as well as the Landsat Next mission — a constellation of three satellites launching around 2030, intended to ensure the continuity of Earth's longest land-observation record.

In Brief

President Trump has pulled the US out of 66 international organizations, including the UN Framework Convention on Climate Change (UNFCCC) and the Intergovernmental Panel on Climate Change (IPCC), in a serious — if not unexpected — blow to global climate cooperation. The White House called the groups “ineffective” and accused them of pushing “radical climate policies” counter to US interests. The move threatens to sideline US scientists from contributing to upcoming IPCC reports, potentially delaying key guidance on adaptation and mitigation strategies. (The White House)

Roughly 1,000 FEMA workers are set to lose their jobs this month amid sweeping workforce changes directed by Homeland Security Secretary Kristi Noem, in a move that could weaken the agency’s capacity to respond to disasters. The cuts target term-limited CORE staff, who make up nearly 40% of FEMA’s workforce and are deployed for disaster recovery and emergency preparedness missions. A leaked planning document also outlines further potential reductions of over 11,500 positions — nearly half of FEMA’s total personnel. (New York Times)

The European Commission has finalized major simplifications to the EU Sustainable Taxonomy reporting regime, set to apply retrospectively from 1 January 2026 for the 2025 financial year. The revised Delegated Act introduces a materiality threshold, streamlined reporting templates, and clarifies the “do no significant harm” (DNSH) criteria for corporates and financial institutions subject to its rules. However, the regulation does not alter the technical screening criteria for substantial contribution to climate change mitigation or adaptation, nor the DNSH criteria related to these two climate objectives. (European Union)

China has launched a trial climate disclosure rule for corporates aligned with the International Financial Reporting Standards’ (IFRS) climate framework. The “Corporate Sustainable Disclosure Standard No. 1 – Climate (Trial)” will initially apply on a voluntary basis, but Beijing plans to gradually expand it across sectors and company types, eventually mandating disclosures. The framework mirrors IFRS S2’s structure — covering climate governance, strategy, risk, and metrics — but goes further by requiring companies to report how their operations, including supply chains, impact climate change. (ESG Today)

SORA Raises $2.5mn to Scale Drone and AI Health Tech Across Africa

Japan-based SORA Technology has raised an additional US$2.5mn in a second close of its latest seed round to support its AI- and drone-powered platform for advancing infectious disease control and climate resilience across Africa.

The company’s tech is already deployed in over 10 countries and aims to integrate with local public health systems to tackle diseases like malaria, which still kills nearly 600,000 people annually on the continent — largely because of gaps in healthcare infrastructure and real-time disease surveillance. SORA’s malaria control platform fuses satellite data, drone surveillance, and machine learning to map outbreaks and guide real-time responses, minimizing resource waste and improving impact.

Source: Ritesh Ghosh / Getty Images

The latest raise brings the company’s total funding to US$7.3mn and brings in three new backers — Daiwa House Group Investment, Central Japan Innovative Research Fund, and UNERI Capital. CEO Yosuke Kaneko says the capital will accelerate AI development, enhance drone systems, and build local operational capacity.

Beyond health, the technology has spillover applications in mining and agriculture. Miners are using its tech for environmental and operational monitoring, while agricultural interests are using the company’s data insights to bolster productivity.

In Brief

An AI-powered weather forecasting system provided 38 million farmers in India with four-week advance notice of the 2025 monsoon onset, marking a major step forward in climate adaptation. Developed by the Indian Ministry of Agriculture and the University of Chicago’s Human-Centered Forecasts Initiative, the system combined AI models from Google and the European Centre for Medium-Range Weather Forecasts with 125 years of rainfall data to deliver localized, probabilistic forecasts across a 200-kilometer grid. The forecasts, sent via SMS in five regional languages, accurately predicted both the early onset of the monsoon and a three-week dry spell. Monitoring data showed strong uptake, with 97% of farmers expressing interest in receiving future forecasts. (Nature Climate Change)

Climate insurance non-profit InnSure has launched Creation Labs, a climate tech incubator designed to fast-track innovations that address insurance protection gaps and decarbonization barriers in underserved communities. Developed with reinsurance firm GreenieRE and backed by a US$5mn NYSERDA grant, the the initiative targets technologies and risk transfer tools that can shield communities from extreme weather impacts while bolstering economic and energy resilience. Applications are open for its second cohort in Q1 2026. (Innsure)

Angel investing syndicate UpRoot Capital has made its first move into climate-driven pests, invasives, and biological (PIB) risk with a pre-seed investment in Molecular Attraction. The Swedish start-up is developing a pheromone-based alternative to pesticides that targets mosquito populations without disrupting ecosystems. The investment amount was not disclosed. UpRoot Capital plans to stand up a venture fund investing in PIB risk management innovations later this year. (UpRoot Capital)

RESEARCH

A standardized indicator reveals sharper increases in heat related mortality in temperate zone cities worldwide (Scientific Reports)

Strong mismatch in climate change adaptation between intentions of private forest owners in Canada and institutional support (Communications Earth & Environment)

Climate change and El Niño behind extreme precipitation leading to major floods in southern Brazil in 2024 (npj Natural Hazards)

Physical climate risk and the pricing of bank loans (Journal of Environmental Economics and Management)

Adaptation Fund Climate Innovation Accelerator Impact Report 2020-2025 (UNDP)

Of the 10 turning points, which do you think was *most* significant?

Thanks for reading!

Louie Woodall

Editor