Source: claudiodivizia / Canva Pro

Event Announcement

🤖 ClimateTech Connect — a leading conference and expo on climate resilience technology for the re/insurance, financial services, real estate, and public sectors — is returning to the Washington, DC area on April 8-9.

Register using the button below, and use code ‘CPVIP’ at checkout for your exclusive 25% discount 👇

In this edition: 💰 Finance ECB fines Crédit Agricole for missing climate risk deadlines, Fitch warns climate shocks could trap vulnerable countries in a sovereign debt spiral & more. 🏛️ Policy Trump moves to repeal the EPA’s endangerment finding, UN climate chief Simon Stiell pushes for stronger corporate engagement in climate delivery & more. 🤖 Tech CarbonPlan launches an open-source wildfire platform challenging closed climate intelligence models, Arbol and Pollen partnership & more. 📝 Research Another round-up of papers and journal articles on all things climate adaptation.

What I’m Thinking About This Week

Adaptation has yet to shake its ‘problem child’ image in climate policy and investment circles, especially when it comes to who should fund and support it. Among Climate Proof readers I’ve spoken with, opinions differ on what will ultimately drive the adaptation economy — policymakers or private markets. I’ve made my own views clear on this in past editions.

Of course, this isn’t an either/or situation. State intervention has to support adaptations that markets can’t or won’t take part in (think of big, hairy infrastructure projects). At the same time, there are some areas where governments need to get out of the way so that people and businesses have the space to enact their own innovative adaptations (looser insurance regulations could be one example).

Then there are those areas where joining forces make sense — like in order to build adaptation markets that don’t currently exist. A new article in Science makes this case in a way that really got the gears turning for me. The authors, drawn from academic institutions across the US and Europe, claim that “missing” markets may be holding back climate adaptation: markets that could come alive and generate social benefits, but have yet to form. This could be for any number of reasons, though the authors cite coordination failures, high transaction costs, weak monitoring technologies, and low demand as key.

In the article, they offer the example of climate-resilient crops as a “missing” market. On paper, the benefits of hardier plants are clear. In practice, development stalls from both sides. Investors hesitate to fund R&D because they are unsure demand for the new crops will materialize, while potential buyers — such as smallholder farmers — cannot signal interest because the products do not yet exist. The result is that a market with clear potential fails to take shape at all.

How to create these missing markets? Ultimately someone or something has to take a lot of risk. For some markets, like for climate-resilient crops, Advanced Market Commitments (AMCs) could be a solution. These are promises to buy or subsidize a fledgling technology if it exceeds certain performance and adoption thresholds. Such promises can be made by the ‘true’ economic buyers of the tech — or a white knight with deep pockets.

Carbon off-take agreements offer one model. These are struck between one or more buyers, typically large corporates, and the provider of carbon removal credits. The provider gets certainty that their credits — once produced — will be sold, on a predetermined schedule and within a set price range. The buyers signal their appetite for the removal credits, helping spur new supply and giving prospective investors clearer evidence that a market exists.

AMC-type arrangements could work to fill “missing” markets for adaptation tech. Climate-resilient crops are just one example. Research-intensive innovations, such as pest and invasive species deterrence, could also benefit from this approach. Even personal heat-resilience equipment for outdoor workers could qualify. Agribusinesses and construction companies, for instance, may be willing to place orders in advance to protect outdoor workforces as extreme heat becomes more common.

In the carbon removals world, offtake agreements were given heft by large corporates eager to prove their sustainability bonafides. This, as recent experience has shown, can be a fickle driver of buyer action. In adaptation, the case should be stronger. After all, this is not about compliance or voluntary pledges in most markets. It is about safeguarding company value and avoiding losses as climate impacts intensify. Moreover, the buyers in adaptation AMCs would receive tangible benefits that filter through to their P&L statements — in contrast carbon removal credits.

Still, given the nascent stage of many adaptation technologies, only a handful of large firms are likely to engage in these sorts of deals. This is where the public sector could act as the white knight, underwriting AMCs that corporates find attractive but remain reluctant to back on their own. Philanthropies could also play a role. Indeed, Climate Proof has caught wind of a philanthropic effort to pool financing aimed at catalyzing private investment in adaptation and strengthening incentives for resilience. Initiatives like these could be structured to support the AMC models that emerging technologies need to prove themselves.

Of course, the risk of failure does not disappear. AMCs can still fall short if technologies fail to scale or deliver on their promises. Even so, these structures may be preferable to forcing early-stage technologies to chase investment before they are ready, or to compete for a shrinking pile of state and federal grant dollars.

Louie Woodall

Editor, Climate Proof

Crédit Agricole Fined by ECB for Missing Climate Risk Deadline

The European Central Bank (ECB) has fined Crédit Agricole €7.55mn (US$9mn) after the French lender failed to produce a materiality assessment of its climate-related and environmental risks on schedule.

The penalty reflects 75 days of non-compliance in 2024 after the bank missed a May 31 deadline to strengthen how it identifies and evaluates exposure to climate and environmental risks across its operations and portfolios. The charge is one of the strongest enforcement actions yet tied to climate supervision in European banking, and marks a shift by the ECB from issuing climate risk guidance to enforcement. Regulators said the scale of the penalty reflected the materiality of the breach, its duration, and the bank’s overall turnover.

The ECB ordered its first climate penalty against Spanish bank Abanca in November for similarly failing to meet a material assessment deadline. The penalties are part of a broader escalation that began with the ECB’s 2020 climate risk guide, followed by a bloc-wide climate stress test and thematic review in 2022 that exposed widespread gaps in banks’ ability to measure and manage climate risks. Supervisors then issued bank-specific timelines to close those gaps, with binding decisions and daily penalties introduced where institutions failed to meet expectations.

Crédit Agricole may challenge the ECB’s decision before the Court of Justice of the European Union.

In Brief

Fitch Ratings is warning that climate-vulnerable countries risk being locked into a worsening debt spiral as extreme weather damages economies and raises borrowing costs, undermining their ability to finance resilience. A new Fitch tool, Climate Vulnerability Signals, finds that 60 of 119 countries assessed could face sovereign credit downgrades by 2050 as physical climate risks and transition pressures intensify, with storm-exposed nations such as the Bahamas, Jamaica and the Philippines among the most exposed. (Bloomberg)

SP Ventures has reached a US$50mn second close for its AgVentures Climate Investment Fund III, positioning the vehicle to scale technologies aimed at strengthening agricultural resilience as climate volatility and geopolitical risks reshape global food systems. The fund is backed by a coalition of development finance institutions, foundations and strategic investors, including the Japan International Cooperation Agency and IDB Lab. The fund’s strategy focuses on biological inputs, ag-focused fintech and supply chain digitalization designed to maintain farm productivity under rising climate stress. (SP Ventures)

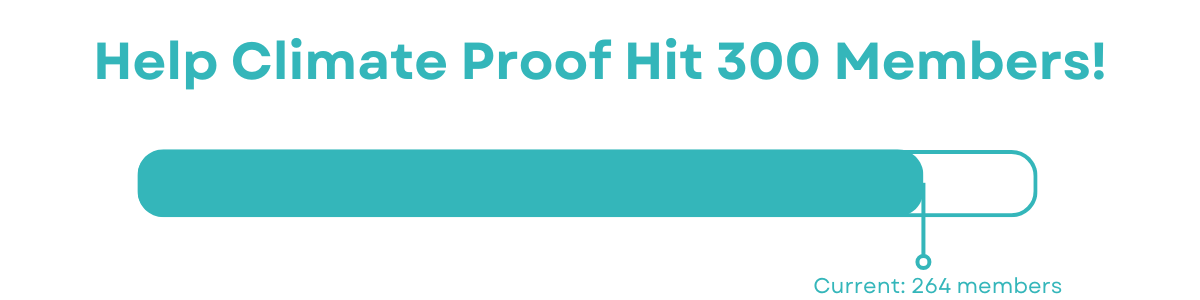

Climate Proof is the only media and intelligence platform dedicated entirely to the Adaptation Economy.

We are supported by paying members, who gain access to in-depth features, unique data products, and events.

We’re only 36 new members away from 300 total.

Will you be the one to take us over the top? 👇

With thanks,

Louie Woodall

Editor

Trump Repeals Climate Finding Underpinning Emissions Rules

President Trump said he would scrub the scientific determination that greenhouse gases threaten public health and welfare from federal rulebooks, paving the way for all limits on climate pollution to be removed.

The Obama-era “endangerment finding” enabled the Environmental Protection Agency (EPA) to regulate greenhouse gases under the Clean Air Act. Once the EPA determined in 2009 that the pollution was dangerous, it allowed the agency to curb emissions across sectors, from automaking to and oil-and-gas production. Since its enactment, the finding has underpinned all manner of climate regulations, though the degree to which these have meaningfully lowered US emissions is contested.

Weaker federal limits raise the likelihood of higher emissions over time, and with them a thicker pipeline of climate damages that land on households, utilities, insurers, health systems and local governments.

The Trump administration’s justification for the rollback leans on a narrower interpretation of the Clean Air Act’s reach, arguing the law is aimed at harms that are more direct and “near the source,” even though mainstream climate science links global greenhouse-gas buildup to intensified heat, drought, wildfire conditions, flooding and other extremes.

Environmental groups and state lawmakers are gearing up to challenge the erasure of the endangerment finding in court. Governor Newsom of California pledged legal action: “If this reckless decision survives legal challenges, it will lead to more deadly wildfires, more extreme heat deaths, more climate-driven floods and droughts, and greater threats to communities nationwide,” he said. California “will sue to challenge this illegal action” and will continue to regulate greenhouse gases, he said.

In Brief

The UN is stepping up efforts to re-engage corporate leaders in global climate talks as the COP process pivots from headline pledges toward implementation. UN climate chief Simon Stiell said closer involvement from the “real economy” would be essential to scaling delivery of existing agreements, highlighting sectoral dealmaking in areas such as agriculture, electrification, and climate resilience as priorities. (Financial Times)

A bipartisan group of US lawmakers has introduced legislation to expand the federal Weatherization Assistance Program, aiming to cut energy costs for low-income households while improving housing resilience and safety. The Weatherization Enhancement and Readiness Act would reauthorize the program through 2030, nearly double the average per-home funding cap to reflect rising retrofit costs, and permanently authorize a readiness program designed to fix structural and health hazards that currently prevent homes from qualifying for efficiency upgrades. (Representative Paul Tonko)

A new Global Center on Adaptation report warns that climate shocks are increasingly shaping security dynamics across the Sahel and Horn of Africa. The analysis finds droughts and floods are most consistently linked to conflict incidents, as prolonged stress on water, land, and livelihoods amplifies existing governance weaknesses and competition between communities. (Global Center on Adaptation)

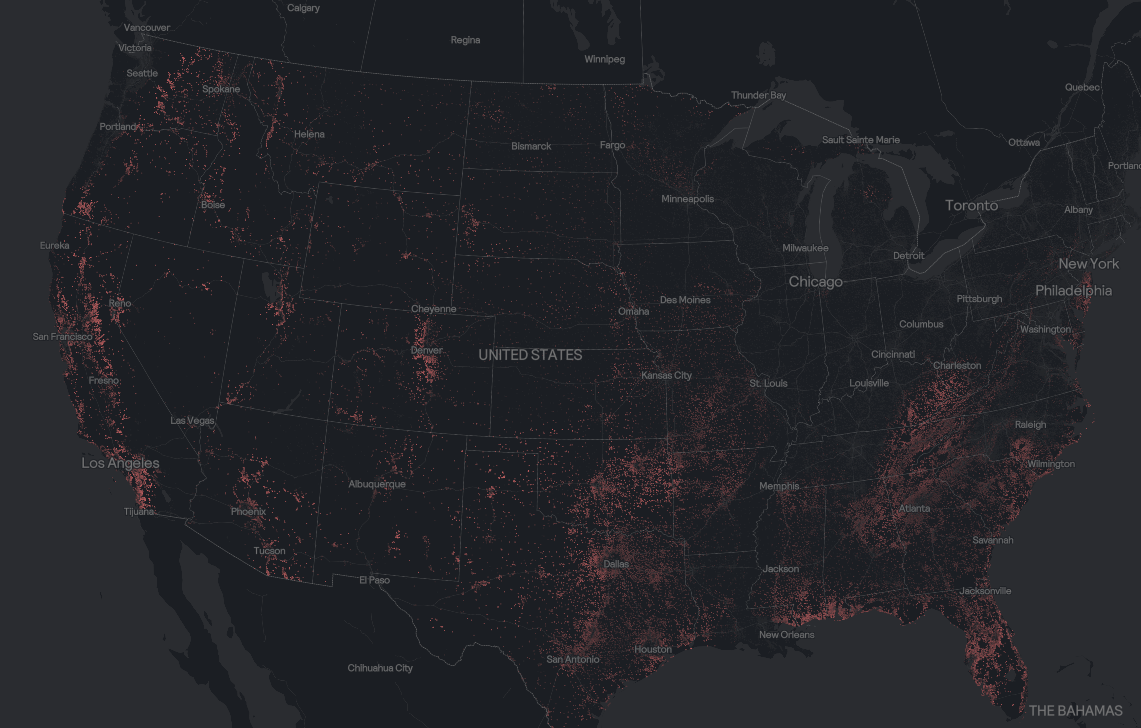

Open-Source Wildfire Tool Challenges Closed Climate Risk Models

Open Climate Risk — a new open-source platform launched last week — is seeking to disrupt the climate intelligence market by making building-level wildfire risk estimates freely accessible across the US.

The platform is the brainchild of CarbonPlan, an NGO that builds open data and tools to improve the transparency and integrity of climate solutions. Open Climate Risk combines publicly available datasets from the US Forest Service and other sources to estimate the probability of wildfire damage to roughly 156 million buildings, using a model that extends burn probability from wildlands into urban sprawl. The platform assigns each building a risk score and shows users the factors behind it. That level of transparency sets it apart from most private tools, which typically keep their methods and assumptions hidden.

CarbonPlan says homeowners, local officials, and planners can examine how risk is calculated, compare properties or neighborhoods, and download data for independent analysis rather than relying on opaque scores that can change how insurance policies are priced, properties valued, and what adaptation decisions are made. The NGO also intends for the tool to drive improvements in the private climate intelligence market by enabling effective model comparisons.

While its coverage is broad, CarbonPlan admits the platform has significant limitations at present, including the absence of building-specific mitigation data, limited treatment of urban fire spread, and sensitivity to a narrow set of modeling assumptions. Still, they argue that exposing those constraints publicly is central to improving public understanding of climate risk measurement and the potential of different adaptation measures.

In Brief

ERM and Jupiter Intelligence have formed a partnership aimed at helping companies and investors turn physical climate risk analysis into operational and investment decisions, as extreme weather increasingly threatens asset values, supply chains and business continuity. The collaboration combines Jupiter’s decision-grade climate hazard analytics with ERM’s advisory and implementation capabilities, allowing organizations to quantify exposure at asset and portfolio level and embed climate risk into capital planning, operational strategy, and resilience investments. (ERM)

Arbol and Pollen Systems are teaming up to launch a parametric insurance product for agricultural climate risk coverage. The solution combines real-time satellite, drone and field data with geospatial analytics, allowing insurers to assess risk and trigger payouts faster as climate impacts unfold. The companies say the integrated approach could shorten claims timelines, improve transparency between insurers and farmers, and better align insurance products with increasingly volatile climate conditions. (Arbol)

RESEARCH

Climate change drives a decline in global grazing systems (PNAS)

Differences in government support for private sector climate change adaptation in developing versus developed countries (npj Climate Action)

Climate models tend to underestimate scaling of UK mean winter precipitation with temperature (Geophysical Research Letters)

Mandatory Sustainability (ISSB) Reporting: Early Evidence from Türkiye (SSRN)

Thanks for reading!

Louie Woodall

Editor