Source: kanzilyou / Getty Images

In this edition: 💰 Finance Blended finance network Convergence says climate projects made up 49% of all transactions last year, ECB report on drought risks & more. 🏛️ Policy UN-convened experts produce new list of adaptation indicators, Trump spending bill passes the House & more. 🤖 Tech Microsoft’s Aurora AI model outperforms traditional forecasting approaches, New York climate innovation hub & more.📝 Research Another round-up of papers and journal articles on all things climate adaptation.

🖥️ THIS THURSDAY: Climate Adaptation Tech Virtual Roundtable

Climate Blended Finance Rose in 2024, but Trump-Era Cuts Threaten Outlook

Blended finance for climate adaptation and mitigation increased last year, but is likely to lose momentum because of cuts to foreign aid and President Trump’s dismantling of USAID, according to the think tank Convergence.

Their latest report reveals that some 60 blended finance deals — 49% of all transactions that closed last year — addressed climate issues, accounting for over US$11bn in total. Blended finance across sectors came to US$18.3bn last year, down from around US$23bn in 2023 but higher than the sums committed in 2020, 2021, and 2022.

However, Convergence is doubtful volumes will grow this year. Development agencies — like USAID and the UK’s Foreign, Commonwealth & Development Office (FCDO) — have been the largest sources of concessional capital for blended finance in recent years, a type of financing that insulates other investors from losses.

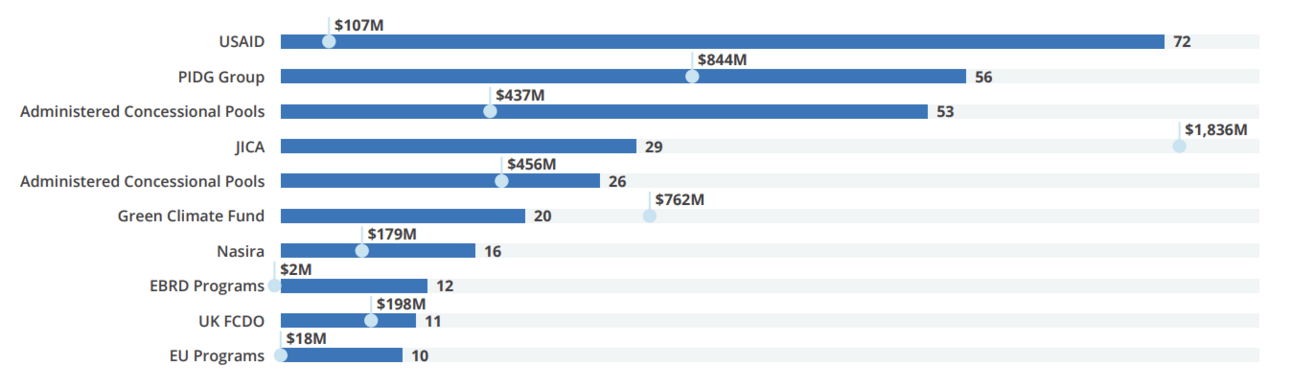

Most Frequent Development Agencies And Multi-Donor Funds In Blended Finance By # Commitments And Aggregate Investment Size, 2022-24

These agencies have severely cut back their spending this year. USAID has cancelled 83% of its projects, according to Secretary of State Marco Rubio, while the UK’s overseas development budget has been slashed by £500mn (US$677mn) this year. USAID made 72 financing commitments amounting to US$107mn from 2022 to 2024, and FCDO 11 commitments totaling US$198mn.

In the private sector, Japanese commercial banks committed the most to blended finance deals in 2022-2024, with Sumitomo Mitsui Banking Corporation contributing US$104mn over 13 transactions. Citigroup was the only US bank among the top contributors, having committed US$62mn across five deals. “Private sector investors continue to be wary of EMDE [Emerging Markets and Developing Economies] investing, including via blended finance. Global investors have rich opportunities to place their capital within developed markets and still meet their impact and climate targets, if any,” the report reads.

In Brief

Drought and water scarcity is the leading climate- and nature-related economic risk in the euro area, with nearly 15% of output exposed, according to the European Central Bank and Oxford researchers. Agriculture is the most vulnerable sector, with up to 30% of output in southern Europe threatened. But water scarcity could disrupt manufacturing businesses too, forcing them to scale back or relocate. Drought could also lower hydropower inflows, curbing electricity generation. The researchers add that impacts in the real economy could ripple through the financial sector and cause instability, as more than 34% of European banks’ loans are exposed to sectors with high water scarcity risk. (European Central Bank)

The Central American Bank for Economic Integration (CABEI) has issued a €30mn (US$34mn) blue bond to fund the sustainable recovery of Lake Yojoa in Honduras. The 30-year instrument, placed with a Spanish investor, is intended to support water management, conservation, and sustainable tourism. This latest placement marks the bank’s fifth blue bond and thirty-first sustainable bond issuance. (CABEI)

The Islamic Development Bank approved over US$1.3bn for projects that foster climate resilience and economic growth in member countries. Among the projects is a US$632mn investment in Oman for building flood protection dams, and around US$241mn for a road rehabilitation initiative in Cameroon. (ISDB)

The Rockefeller Foundation and Wellcome have partnered to invest US$11.5mn in the Climate and Health Joint Programme run by the World Meteorological Organization and World Health Organization. The funding will support initiatives that provide vulnerable communities in poor countries with real-time weather alerts and early warnings so they can better manage extreme weather and climate-related health threats. (The Rockefeller Foundation)

Investment firm Renaissance Partners and private equity fund TPG Rise Climate have teamed up to acquire a controlling stake in SICIT, a specialist in biostimulants — which are used to enhance soil nutrition and bolster agricultural yields. Joerg Metzner, Business Unit Partner at TPG Rise Climate, said the transaction represents the fund’s “first investment in the Adaptation and Resilience sector”, claiming the production of biostimulants is essential to relieving pressure on crop yields and available arable land. (TPG)

New analysis from climate risk intelligence firm First Street projects that home foreclosures across the US due to floods, windstorms, and other extreme weather events could cost mortgage lenders US$1.2bn this year, and over US$5bn by 2035. In ten year’s time, such events could make up for 30% of all foreclosure credit losses experienced by mortgage lenders, up from 7% this year. (First Street)

Reinsurance broker Gallagher Re estimates that the tornadoes, thunderstorms, and hailstorms that tore through the US from May 14-20 could cost the US insurance and reinsurance industry US$4-7bn, bringing year-to-date total losses from these perils above US$20bn. This marks the eighth year in the last nine with losses exceeding US$20bn, the company says. (Artemis)

🎯 We’re Making Progress Towards Our Member Target…

Today, Climate Proof has 1,360 free subscribers and 156 paying members.

We have 127 days to hit our 300 paying members goal — or all this could go away.

Each paying member helps keep the Monday news round-up humming, ensuring that the best in adaptation finance, tech, and policy news gets to those who need it most.

If by September 30 we don’t have enough members, Climate Proof may have to shut up shop — meaning the only pure-play adaptation publication could disappear from the web forever.

While we’re confident we can hit our goal, we need your help. So be a legend, and get us closer to 300 by upgrading now👇

Not only will you be supporting independent journalism that puts adaptation first, you’ll get access to premium content including in-depth features, the Adaptation10 report series, S&P Climate Risk Signals, Climate Adaptation Tech Roundtables, and much more.

Thank you for your support — it truly means the world!

UN Unveils 490 Adaptation Indicators to Advance Global Resilience Progress

UN-convened experts have drawn up a list of 490 potential climate adaptation indicators out of an initial tangle of more than 9,000 — an important step toward a global scorecard that could help nations withstand climate shocks and steer billions of dollars into resilience projects.

The proposed indicators are organized across seven themes and four cross-cutting dimensions. Infrastructure and human settlements dominate the list with 99 indicators, reflecting the massive effort needed to harden roads, bridges, and power grids. The leanest cluster — made up of 18 indicators — covers impact, vulnerability, and risk assessment.

Initial (Left) And Current (Right) Breakdown Of Adaptation Indicator Options

The total list is split into 288 “main” and 202 “sub-indicators.” Roughly two-thirds are drawn from earlier submissions; the experts wrote or refined 182 new metrics to better address adaptation needs. Among the new indicators are those that tally how many countries maintain up-to-date assessments of climate hazards, impacts and exposure, and how many translate those findings into their National Adaptation Plans and related policies.

The indicators are key to gauging progress toward the Global Goal on Adaptation (GGA), which was established under the 2015 Paris Agreement. This calls on countries to strengthen their resilience and reduce their vulnerability to climate impacts. In 2023, UN member states formed the United Arab Emirates–Belém work programme with a two-year mandate to develop the indicators. At last year’s COP29 climate summit, countries agreed the work programme should produce a “manageable set” of 100 indicators that are “globally applicable” and able to capture “various contexts of adaptation action.”

Once finalized, the indicators could help structure countries’ National Adaptation Plans and unlock public and private finance for specific adaptation efforts. They could also cascade down to the sub-national and regional levels, making it easier to identify local adaptation needs and signal to private and public investors which innovations should be prioritized.

“With the updated GGA indicators, there are no longer any excuses for governments, financial institutions, civil society, and corporations to not enhance resilience,” Sabrina Bachrach, adaptation and resilience finance expert, told Climate Proof.

The potential indicators will be scrutinized by parties at the Bonn Climate Conference, the traditional curtain-raiser to the annual COP meetings, taking place in June. A final set of indicators is slated to be approved at COP 30 in Brazil this November.

In Brief

UN Climate Change Executive Secretary Simon Stiell said that strong national climate plans can help counter economic uncertainty and promote growth and stability. In a speech at the 2025 Nature Summit last Tuesday, he also highlighted the importance of political leadership and cooperation among nations when it comes to building economic and climate resilience: “We simply cannot afford a two-speed transition, where some countries race ahead with clean energy and climate resilience and leave others behind. Because a supply chain is only as strong as its most fragile link,” he said. (UNFCCC)

G7 finance ministers reaffirmed the importance of Climate Resilient Debt Clauses in loans to poor, climate-vulnerable countries following a meeting in Alberta, Canada last week. These clauses allow nations hit by climate hazards or other natural disasters to pause repayments to lenders, thereby freeing up capital for immediate response and recovery efforts. The G7 ministers also encouraged international financial institutions “to strengthen their focus on crisis prevention in order to reduce the incidence of crises materializing.” (G7)

The US House of Representatives passed President Trump’s signature tax and spending bill by a razor-thin 215-214 vote last Thursday. The legislation dismantles environmental protections, promotes fossil fuel use, and would scrap billions in Biden-era funding for climate adaptation and resilience projects. It also undermines national climate resilience efforts by rescinding funds for the National Oceanic and Atmospheric Administration, the National Marine Sanctuary, and coastal community protections. All but two House Republicans voted for the bill, with all Democrats against. The bill now moves to the Senate, where it faces significant opposition. (Eos)

The Trump administration has terminated or frozen over US$2.2bn in federal research grants to Harvard, hitting climate and environmental health studies especially hard. Key projects that had been backed by the National Institutes of Health covered pollution, heat exposure, and air quality. Major clinical trials and studies on climate-related health disparities have also been affected. Researchers warn that years of scientific progress — and lives — may be lost as funding disappears midstream. (New York Times)

The Federal Emergency Management Agency has rescinded its 2022–2026 strategic plan without a replacement, part of a broader Trump-era shakeup under Acting Administrator David Richardson. The plan laid out the goals and objectives for the agency when responding to disasters, including leading “whole of community in climate resilience” and promoting disaster readiness. Insiders warn its elimination leaves the agency unmoored just as hurricane season steps into gear. (Wired)

In a hearing last Monday, a federal appeals court appeared skeptical of the Environmental Protection Agency’s rationale for abruptly canceling US$20bn in Biden-era climate grants to a group of non-profits. The three-judge panel questioned Administrator Lee Zeldin’s authority to terminate the funding, which had been approved by Congress, though two members raised the possibility that the case may have to be resolved in the Court of Federal Claims, which handles contract disputes. (Politico)

A US District Court judge has ordered the Trump administration to restore US$176mn in frozen climate and environmental grants to 13 nonprofits and six municipalities. The funding, which had been approved under the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, was halted as part of President Trump’s effort to curb spending on his predecessor’s policy priorities. Among the projects affected by the freeze were those addressing local air and water pollution, community adaptation projects, and initiatives to support small farmers. (Southern Environmental Law Center)

A new study of insurance claims in Alabama following Hurricane Sally in 2020 shows that homes built or retrofitted to Insurance Institute for Business & Home Safety (IBHS) Fortified standards suffered dramatically less damage. If all homes had been built to the Fortified Gold Standard — the highest level — insurer payouts could have been cut by up to 75% and homeowner deductibles by 65%. The study supports policies like Alabama’s mandatory insurance discounts and grant program for Fortified upgrades as a means of boosting climate resilience and insurability. (Alabama Department of Insurance)

Brazil is working on a comprehensive strategy to strengthen adaptation across the global health sector. The Belém Health Action Plan, due to be finalized by the COP 30 summit, is focused on three core themes — surveillance, evidence-based policymaking, and innovation — which together could help countries build climate-resilient healthcare systems. Countries are invited to submit supporting documents by June 10 showcasing proven adaptation policies and practices, which will inform global discussions at the Health and Climate Conference in Brasília this July. (World Health Organization)

The Maldives has launched a new project to enhance its early warning systems and disaster preparedness against climate risks. With support from China and the UN Development Programme, the South Asian island nation will upgrade its forecasting infrastructure and bolster its communication programs to be more inclusive and accessible to at-risk populations. (UNDP)

Microsoft’s AI Model Beats Traditional Forecasts, Paper Claims

An AI model from Microsoft is able to predict extreme weather and atmospheric events faster and more accurately than traditional forecasting systems, a new paper in Nature claims. The tech could make climate hazard warnings cheaper and more accessible to vulnerable populations.

Aurora is an AI foundation model, trained on over one million hours of data, that can be finetuned to predict not just the weather, but air pollution, ocean waves, tropical cyclone paths, and more. For medium-range weather forecasts — the kind people rely on in weather apps — Aurora was able to beat current numerical and AI approaches at the city and town scale across 91% of targets.

Source: ekapol / Getty Images

The Nature paper adds that Aurora accurately predicted the landfall of Typhoon Doksuri in the Philippines in June 2023, four days before the event. The storm inflicted more than US$28bn in damage — the costliest Pacific typhoon to date. Official forecasts mistakenly predicted the storm would pass over Taiwan.

The model also predicted a sandstorm that ripped through Iraq in June 2022, one of several such catastrophes that led to more than 5,000 hospitalizations in the Middle East. Aurora forecast the storm one day in advance “at a fraction of the computational cost”, the paper says.

Aurora’s source code and model weights have been made publicly available, offering developers the opportunity to build on Aurora to produce their own innovations and apps.

Microsoft is not the only tech giant innovating in the AI weather forecasting space. In December, Google unveiled GenCast, a tool built on generative AI models, which it claims can provide accurate 15-day weather forecasts, beyond long-held predictability limits.

In Brief

Researchers at the University of Texas at Austin, together with Cognizant AI Labs, have developed an AI tool that can produce optimal environmental policy solutions in support of UN sustainability goals — including on land use and climate resilience. The tool has been submitted as part of Project Resilience, a UN-backed effort to create a public AI utility that can address global decision-augmentation challenges. (University of Texas)

Carbon Blue Solutions has introduced the Oasis Cone, a planting system that supports the growth of mangroves and salt-tolerant crops in arid deserts. The cone enables these plants to be sustained using only saline groundwater, eliminating the need for fresh water. The low-cost tech is slated for deployment in regions with poor soil quality to enhance food security and increase carbon capture. Initial pilot projects are launching in Egypt and Oman. (Carbon Blue Solutions)

New York City Mayor Eric Adams and the New York City Economic Development Corporation (NYCEDC) have announced the development of “BATWorks”, a 200,000 square-foot climate innovation hub at the Brooklyn Army Terminal. The center aims to support 150 start-ups over 10 years and generate some US$2.6bn in economic impact, while creating over 600 jobs. BATWorks is being designed and operated by a consortium that includes the Los Angeles Cleantech Incubator and Cambridge Innovation Center. (NYC Mayor)

RESEARCH

Integrating adaptation and mitigation actions within built environment policy portfolios: an Australian local government comparison (npj Climate Action)

Flood risk assessment with machine learning: insights from the 2022 Pakistan mega-flood and climate adaptation strategies (npj Natural Hazards)

Managing for climate and production goals on crop-lands (Nature Climate Change)

Irreversible glacier change and trough water for centuries after overshooting 1.5 °C (Nature Climate Change)

Is coastal climate adaptation infrastructure worth public investment? Evidence from stated preference economic valuation and cost-benefit analysis (Journal of Environmental Management)

Warming of +1.5 °C is too high for polar ice sheets (Communications Earth & Environment)

Human mobility amplifies compound flood risks in coastal urban areas under climate change (Communications Earth & Environment)

The opportunity for climate action through climate-smart Marine Spatial Planning (npj Ocean Sustainability)

Insurance and risk management tools for agriculture in the EU (European Commission)

Logistics in a +2°C world (Kuehne Climate Center)

Climate and biodiversity risks to EU food imports (Foresight Transitions)

How can nature support resilience planning and climate action in cities? (AFD)

Extreme weather in Europe 2024: The year of the flood (Milliman)

Thanks for reading!

Louie Woodall

Editor